T-Bills demand soars as T-Bond falters in auction

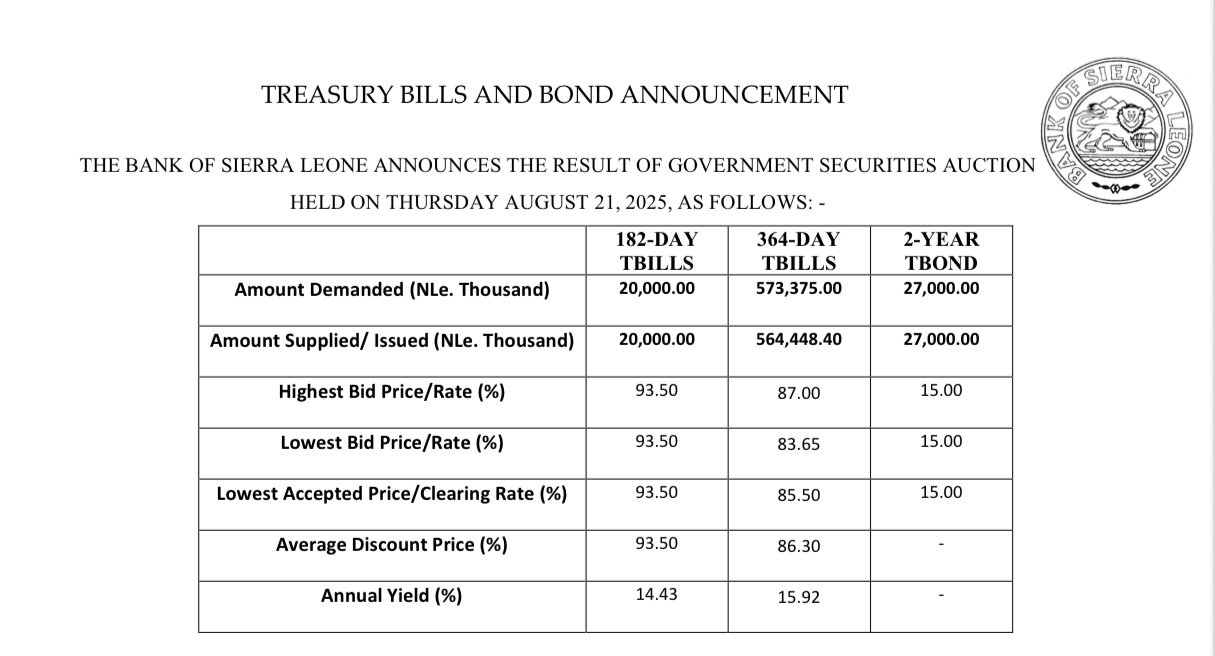

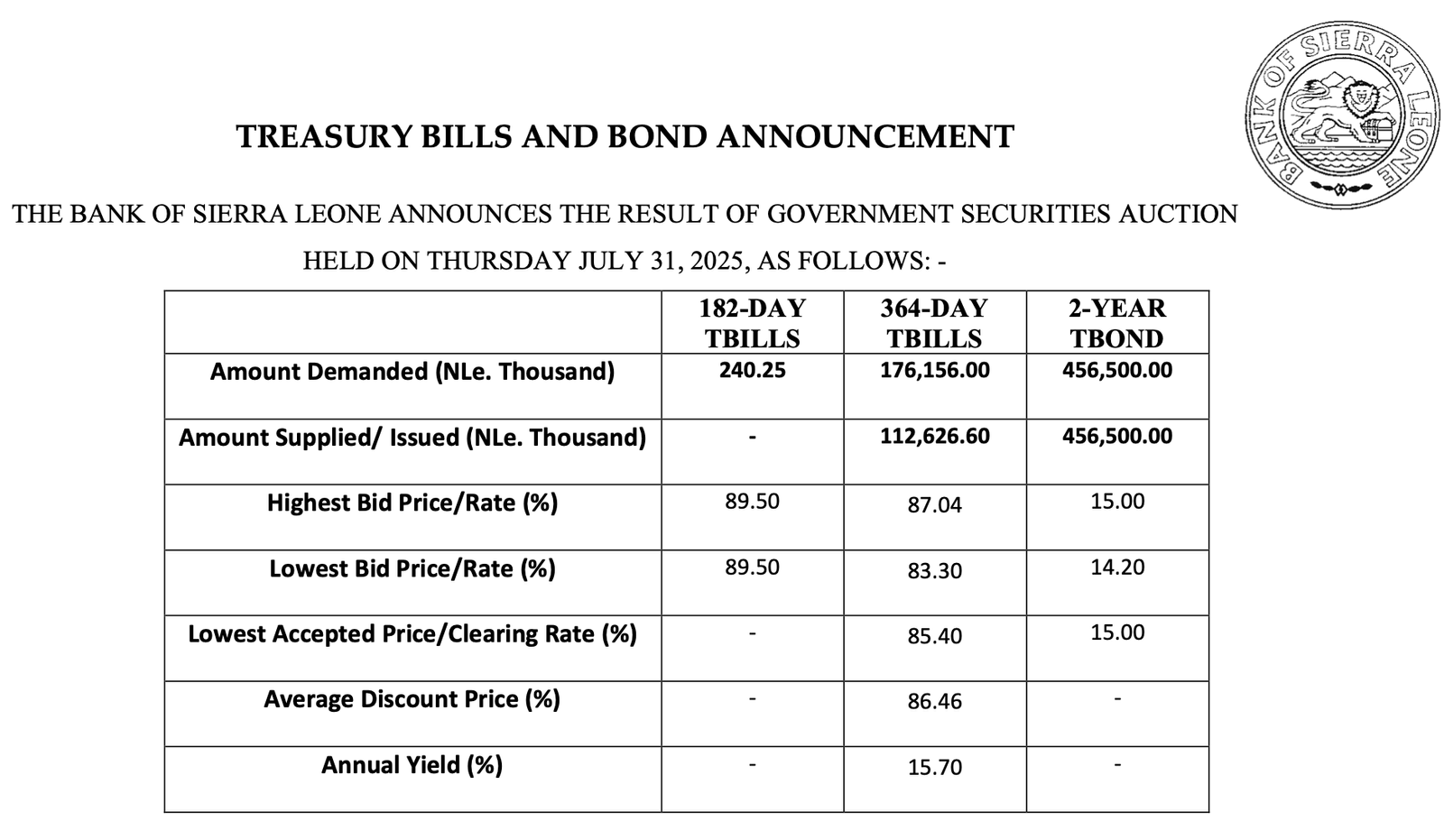

Results of the government securities auction held on August 7 released by the Bank of Sierra Leone (BSL) indicated robust investor appetite for short-term instruments, and a notable absence of interest in longer-term bonds.

The auction revealed significant demand for the 365-day Treasury Bills (T-Bills), with the full NLe528,155.90 thousand demanded being supplied by the BSL, with strong investor appetite for long-term government debt.

This suggests continued confidence in the long-term outlook of the nation’s economy, a strategic preference for longer maturities given prevailing economic uncertainties.

The yield on these bills settled at 16.28 percent, reflecting a weighted average discount price of 86.04 percent. The range of bids was substantial, spanning from a high of 90.05 percent to a low of 84.75 percent, with the lowest accepted price aligning with the latter. This wide range indicates varying risk assessments among bidders, likely based on differing forecasts for inflation and the exchange rate.

Notably, the auction details reveal a different story for shorter-term instruments. While NLe45,000.00 thousand was demanded for the three-year Treasury Bond (T-Bond), none were issued.

This absence of supply, despite the demand, raises questions. It suggests the BSL’s unwillingness to issue at the bid rates offered (between 20 percent and 22 percent), suggesting a disagreement on the perceived value of the longer-term instrument.

Critically, the absence of activity in the 182 T-Bills category is even more concerning. No demand was recorded whatsoever, signalling a turn-down of investor appetite for shorter-term government debt at this juncture.

This apparent risk aversion towards longer-term instruments could stem from several factors. Investors might be wary of committing capital for extended periods amidst ongoing global economic volatility and development surrounding Sierra Leone’s macroeconomic trajectory.

The high yield on the 364-day T-Bills could also be diverting investment away from longer-term bonds, offering a seemingly less risky and relatively liquid alternative.

The Implications of these auction results are significant for the government. The success in the 364-day T-Bills segment provides much-needed longer-term liquidity. However, the failure to attract investment in shorter-term debt instruments could alter efforts to finance development projects and manage overall debt profile.

It is pertinent for the BSL to carefully consider its strategy for future auctions, by addressing investor concerns regarding macroeconomic stability, offering more competitive yields on longer-term instruments, and communicating a clear and convincing narrative about the government’s economic plans in restoring confidence and attracting much-needed investment in long-term growth.

Crucially, the BSL maintains the discretion to adjust the auction size by up to ten percent, providing flexibility to manage liquidity and respond to evolving market conditions, a clear communication to maintain investors confidence and avoid perception of unpredictability.

The unwillingness to Issue 182-Day T-Bills and three-year T-Bonds in the latest auction suggests careful fiscal management, potentially prioritizing affordability over fulfilling immediate demand at unfavourable rates.