BSL bond auction signals investor confidence, yield curve watch

Sierra Leone’s government securities auction has revealed intricate market dynamics that suggest growing investor confidence and sophisticated monetary management by the Bank of Sierra Leone (BSL).

The latest auction, conducted in July 2025, demonstrated a nuanced approach to debt financing, with investors showing a strong preference for medium to long-term instruments despite potential economic uncertainties.

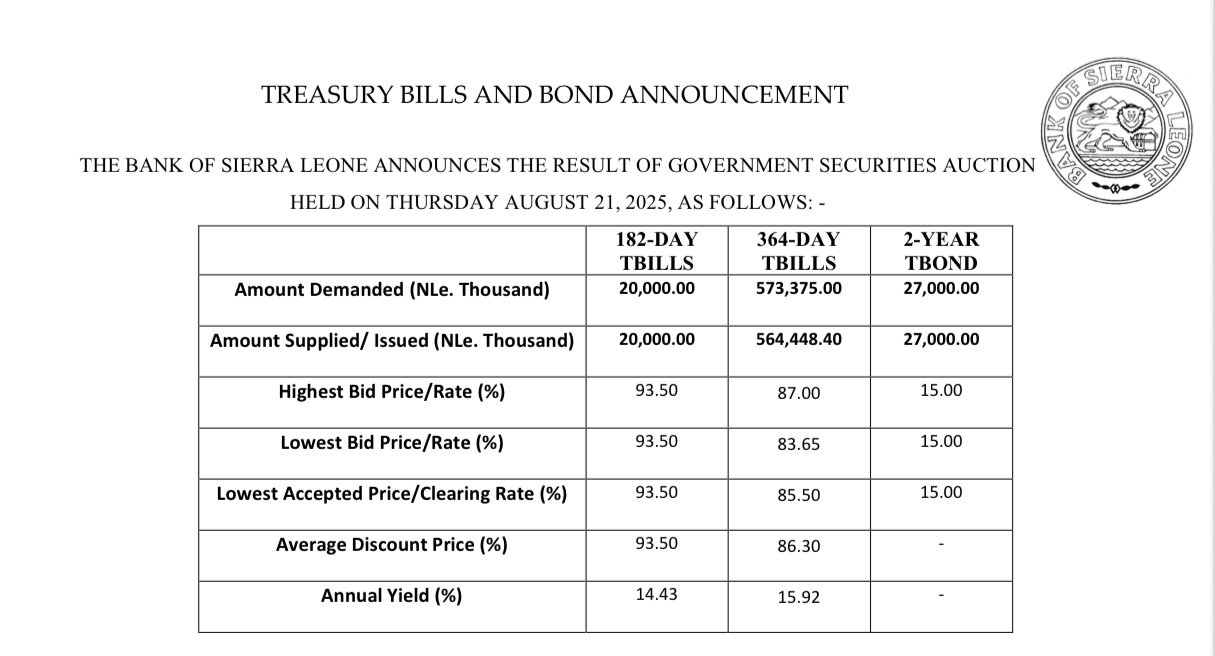

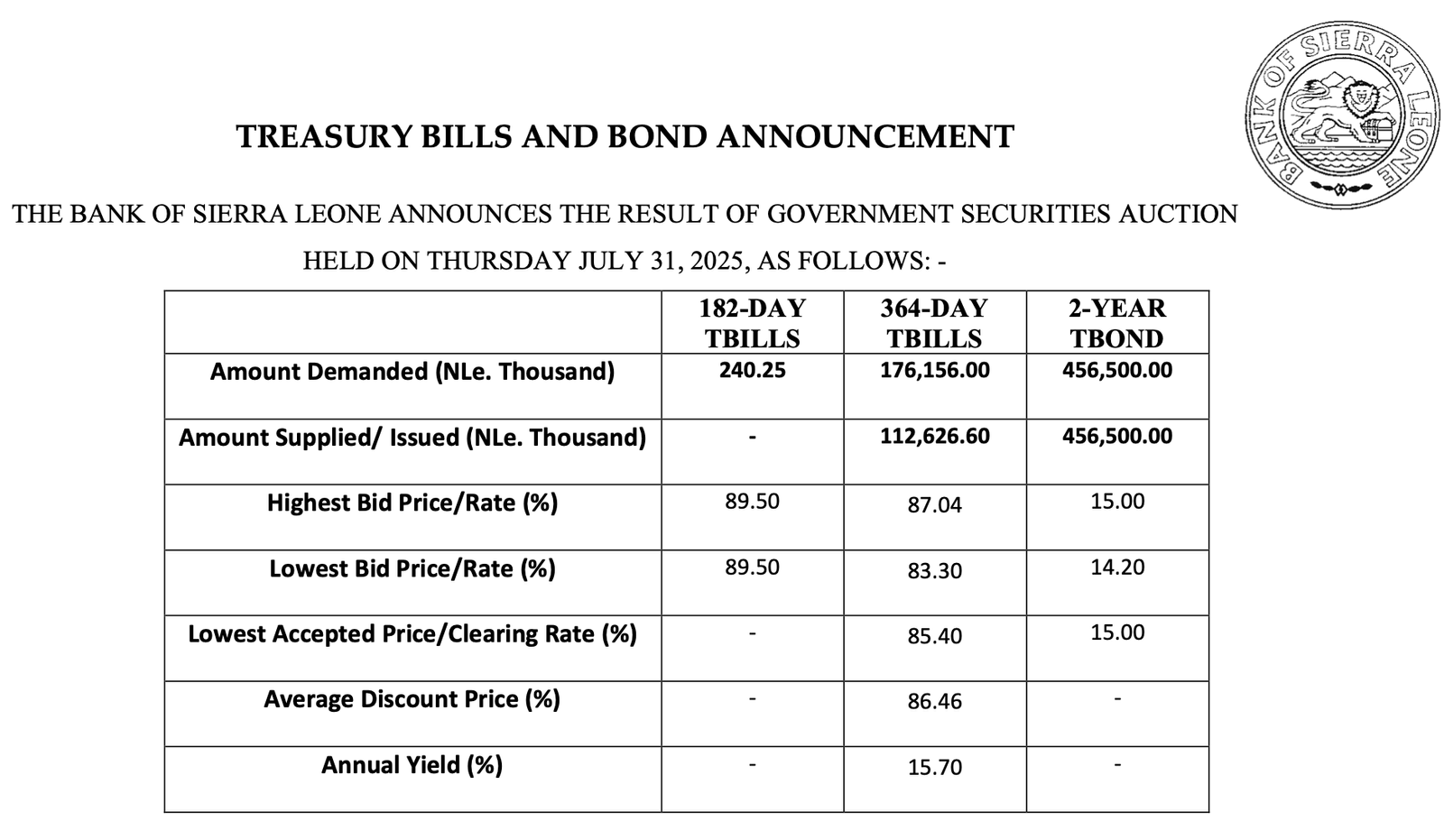

Most notably, the 2-Year Treasury Bond emerged as the standout performer, achieving full subscription at a robust 15.00 percent yield. This signals husky investor sentiment and a potential vote of confidence in Sierra Leone’s economic trajectory, comfortably within the offered yield range of 14.20 percent to 15.00 percent.

The complete take-up of the NLe 456,500 (thousand) offering underscores a broader narrative of economic stability and attractive investment opportunities.

In contrast, the short-term 182-Day Treasury Bills experienced a more tepid reception. With demand at NLe 240,250 (thousand) but only NLe 112,626.60 (thousand) issued, the BSL appears to be strategically managing liquidity and setting a sophisticated signalling mechanism about its monetary policy intentions.

The 364-Day Treasury Bills painted a more optimistic picture, with full subscription and a compelling 15.70 percent yield. The entire amount was supplied, indicating a healthy appetite for this maturity period. The lowest accepted price, or clearing rate, landed at 85.40 percent, translating to an average discount price of 86.46 percent. This translates to a yield of 15.70 percent.

This suggests investors are finding medium-term government securities increasingly attractive, potentially indicating a maturing financial ecosystem.

These auction results hint at several critical insights from macroeconomic perspective. The yield curve’s current configuration suggests a potential inversion risk, a phenomenon financial analysts typically interpret as a potential harbinger of economic recalibration.

The pronounced appetite for the 2-Year T-Bond relative to the undersubscribed 182-Day T-Bills raises the spectre of a flattening. This economic indicator, where short-term debt instruments yield higher returns than long-term ones, is often seen as a precursor to economic slowdowns.

The BSL's selective approach to debt issuance indicates a nuanced strategy of managing market expectations while maintaining fiscal flexibility. The investor sentiment gleaned from this auction is largely positive.

The upcoming week's securities offer, totalling over NLe 458 million across various instruments, will be a critical indicator of whether these market trends represent a sustained shift or a temporary market fluctuation.

Investors and economic policymakers will be closely monitoring these developments, as they provide a real-time snapshot of Sierra Leone’s financial health, investor confidence, and the government’s strategic financial management capabilities.

The auction results underscore a narrative of cautious optimism, with the BSL demonstrating a sophisticated approach to debt management that balances short-term fiscal needs with long-term economic stability objectives.

As Sierra Leone continues to position itself in the global financial landscape, these nuanced market interventions will be crucial in attracting foreign investment, managing economic expectations, and driving sustainable economic growth.