Investors Rally Treasury Bills At SLe316m

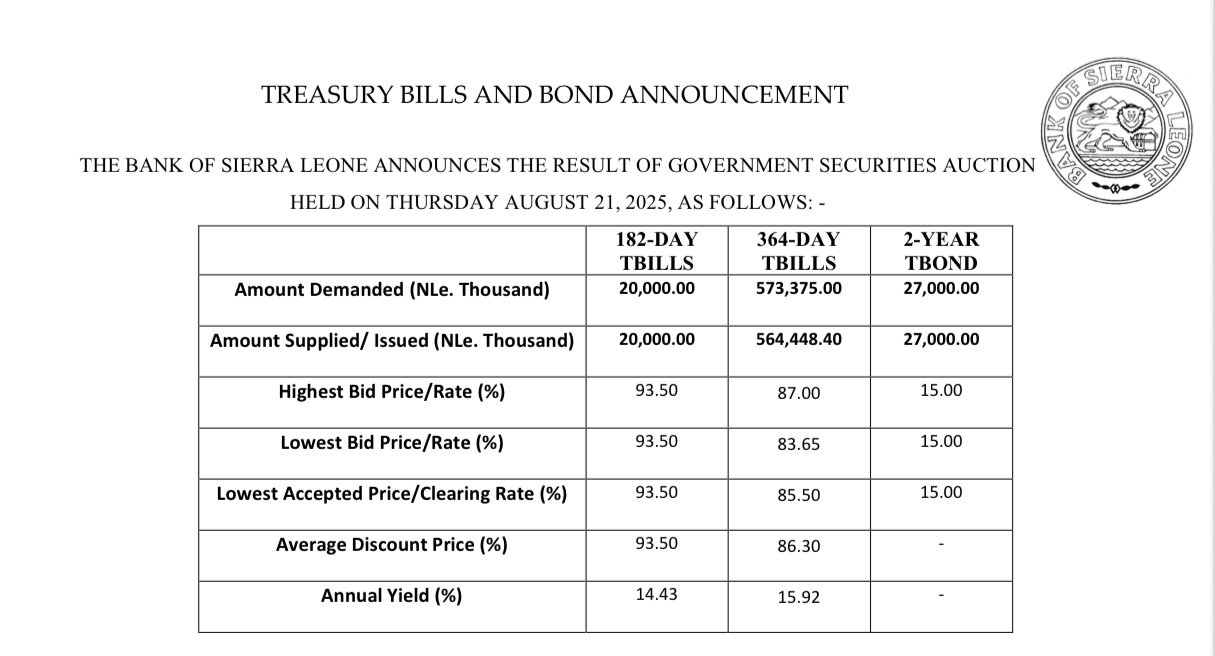

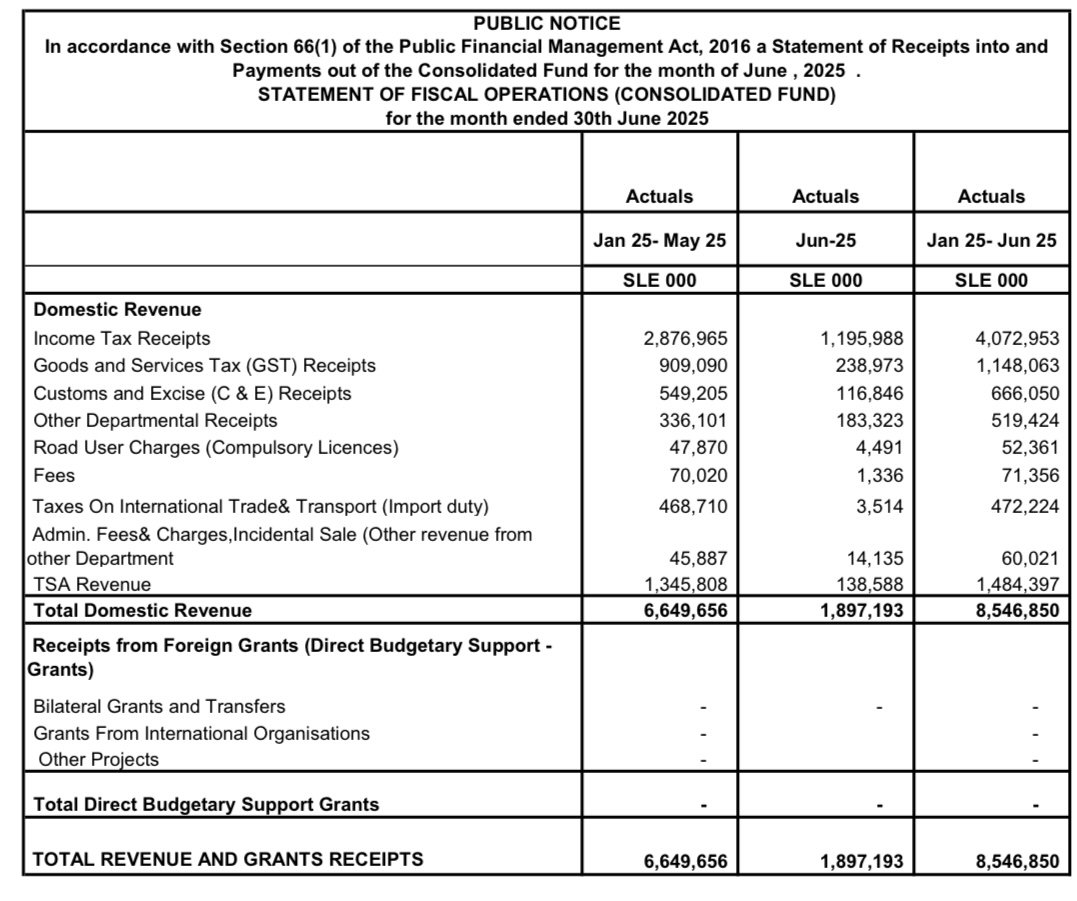

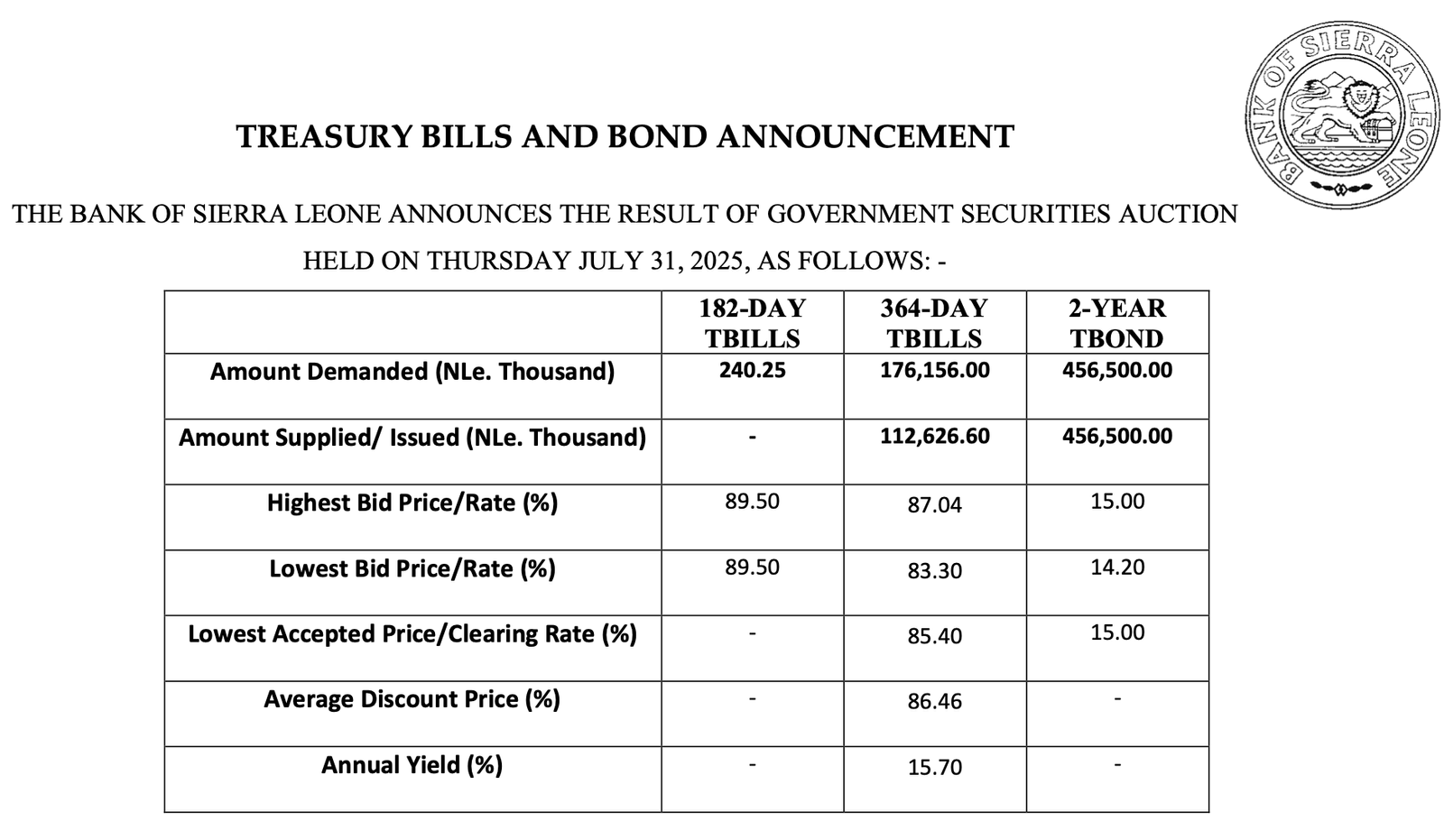

Renewed interest in Treasury Bills has seen investors staking over SLE316.1 million on the financial instrument so far this year. A total of SLE 316,189,000 accrued in to government from the sale of the bills between the months of January and May, 2025.

A whopping SLE 65.52 million was recorded as sales in the month of May alone. In the previous 4 months to April, 2025, a total of SLE 250 million worth was sold. This development reveals the crave for this financial instrument which play crucial role in government financing and monetary policy. It equally provides a low-risk investment option for investors.

Treasury bills (T-bills) are short-term government securities with maturities ranging from a few weeks to a year. FS sources at the Bank of Sierra Leone (BSL) explained that the interest of investors may not be unconnected with the low-risk nature of T-Bills. ‘Treasury Bills are low-risk investment. The bills are considered exceptionally negligible risk; this makes them very attractive to investors seeking safe havens. It is also quite liquid and can be easily bought and sold in financial markets.

The apex bank – the Bank of Sierra Leone, our sources explained further has found the use of T-Bill a good monetary policy tool to implement monetary policy, influence interest rates and moderate money supply in the economy. ‘The government also use T-bills to manage short-term cash needs and finance its operations.