Government debt appetite remains strong, as yields inch up

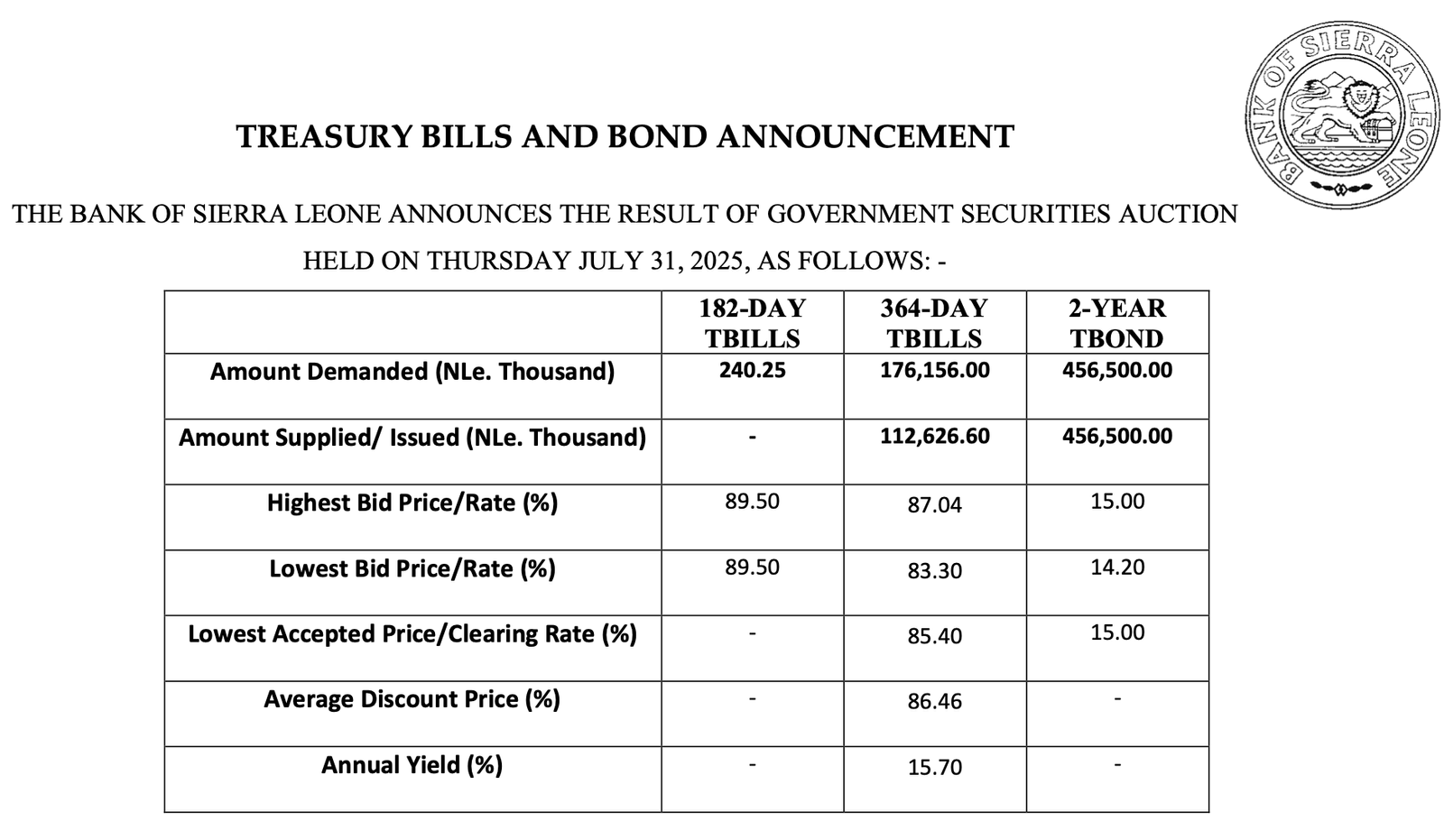

The demand for government debt remained robust in the latest auction, where yields saw a slight increase, according to auction result by Bank of Sierra Leone (BSL) held on August 28, 2025.

The data show tight supply relative to demand, with yields and pricing pointing to modest appetite which demonstrated continued investor confidence, and a notable absence of the 2-year Treasury Bond (T-Bond).

Pricing at the auction indicated the dynamics for shorter-term 182-day Treasury Bills (T-Bills) saw modest participation, with the amount demanded matching the amount supplied at NLe 53.4 thousand. The bid price remained consistent across the board, with a highest, and lowest accepted price all fixed at 93.70 percent, translating to an annualized yield of 13.94 percent.

This signals a relatively tight distribution around the high end of bids and a moderate carry for holders, a static bidding which suggests a lack of competitive pressure within this segment, possibly due to the relatively small amount offered.

The 364-day T-Bills, however, painted a more compelling picture. Demand far outstripped supply, with investors bidding for NLe 457,700.90 thousand against a supply of NLe 457,566.30 thousand. This oversubscription highlights the continued appetite for longer-term debt, even as investors carefully weigh the risks.

The highest bid price stood at 86.65 percent, while the lowest dipped to 85.45 percent. The BSL ultimately cleared at a rate of 85.50 percent, resulting in an average discount price of 85.84 percent and an annualized yield of 16.55 percent.

A closer examination of these figures reveals a subtle but significant shift. While demand is undeniably healthy, the annualized yield of 16.55 percent on the 364-day T-Bills represents a marginal increase.

Analysts believe this uptick reflects growing concerns about inflation and the BSL's potential future monetary policy responses. It signals that investors are demanding a slightly higher premium to compensate for the perceived risk of holding Sierra Leonean debt in the face of economic headwinds.

Demand-supply parity, especially in the 364-day tenor, suggests a measured appetite for longer-dated securities at prevailing yields, with investors seeking higher compensation for duration risk. The higher yield indicates a crowding into longer maturities for yield pickup, which may influence subsequent debt issuance and rollover planning.

As the BSL continues to manage debt maturities in a context of cautious liquidity and domestic demand for safe assets, market participants will be watching how the next auctions balance yield, price, and execution efficiency amid evolving macro conditions.