BSL auction gains momentum as Investors demand more for T-Bills

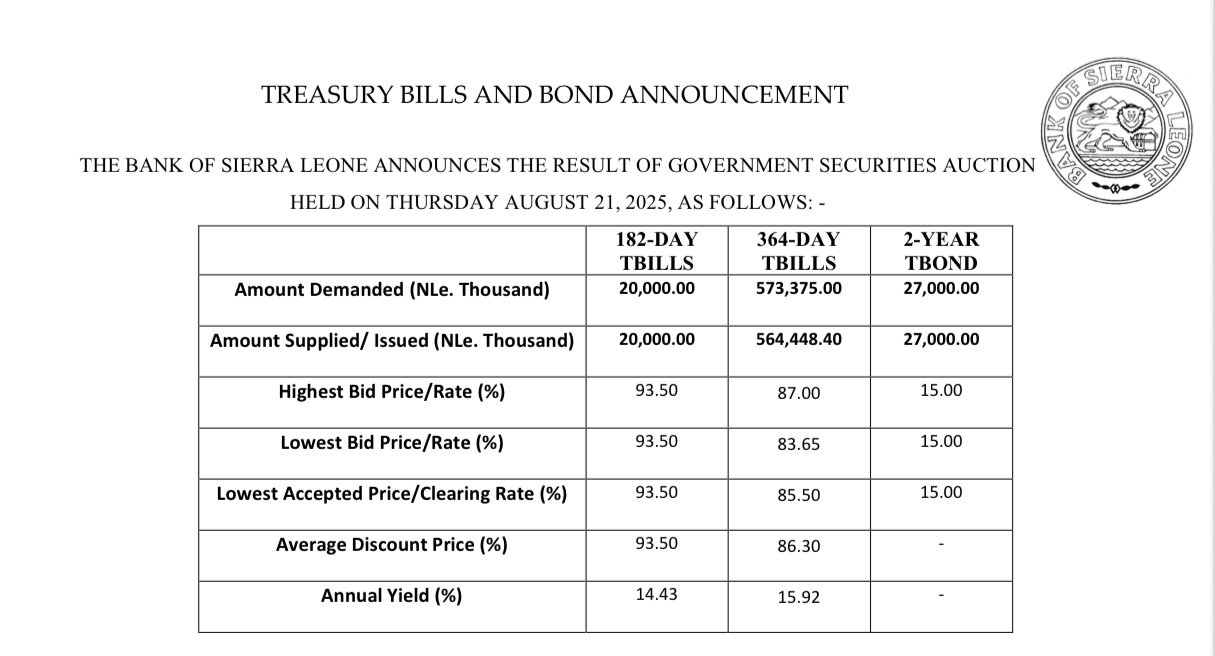

Results of the Bank of Sierra Leone’s government securities auction held on August 21, 2025, reveal a strong appetite for Leone-denominated debt, particularly for the 364-day Treasury Bills (T-Bills) in the domestic market.

While the BSL met the demand for the shorter-term 182-day T-Bills and the 2-year Treasury Bonds (T-Bonds), it partially filled the orders for the highly sought-after.

The auction data reveals that demand for the 182-day T-Bills perfectly matched the BSL’s offering, with NLe20,000 (New Leone) in demand met by an equal issuance. The clearing rate stood at 93.50 percent with the same highest and lowest bid price, indicating a highly competitive but narrowly met take-down, that translates to an annual yield that clocked in at 14.43 percent, signalling a relatively elevated short-end yield in line with tightened liquidity conditions and inflation considerations.

However, the 364-day T-Bills witnessed significant oversubscription. Investors demanded NLe573,375 with NLe564.448.40 issued, leaving a sizeable gap between demand and supply.

The accepted prices ranged from a high of 87.00% to a clearing rate of 85.50 percent, culminating in an average discount price of 86.30 percent This translates to an annual yield of 15.92 percent, slightly higher than the shorter-dated instrument, reflecting the increased risk premium associated with the longer maturity, underscoring investor appetite for longer cash profiles amid higher yields.

The 2-year T-Bonds saw demand mirroring the supply at NLe27,000 keeping the outcome fully subscribed on the supply side. All bids were accepted at a rate of 15.00 percent, which points solid appetite for a mid-term instrument among institutions seeking predictable, longer-duration cash flows.

The 182-day T-Bills note shows tight alignment between demand and supply, suggesting a balanced short-term liquidity need without an overhang. The 364-day TBills exhibit a more robust demand relative to supply, implying investors are seeking diversification toward a longer one-year horizon in a context of rising yields.

The BSL's decision to partially fill the demand could be interpreted as a strategic move to manage liquidity within the financial system and avoid pushing yields too low. It remains to be seen how this partial fulfilment will impact secondary market trading of these securities and the adjustments of issuance strategy in subsequent auctions to meet the apparent strong investor demands.

The subscription patterns point to continued demand for instruments that balance liquidity with income generation, positioning Sierra Leone’s sovereign debt market as an active, price-discovery venue in a rising-yield landscape.