Leone indicates volatility against dollar in mid-year review

From January to July 2025, the exchange rate between the Sierra Leonean Leone (SLL) and the US Dollar (USD) has undergone notable fluctuations, reflecting a complex interplay of domestic economic factors and global market trends.

As of late July, one US Dollar was valued at approximately 23,076 SLL, demonstrating a slight increase of 0.55 percent or 126 SLL compared to previous weeks, according to data from the Bank of Sierra Leone and Trading Economics.

Throughout the first half of the year, the exchange rate exhibited a general upward trend, with the Leone depreciating against the dollar.

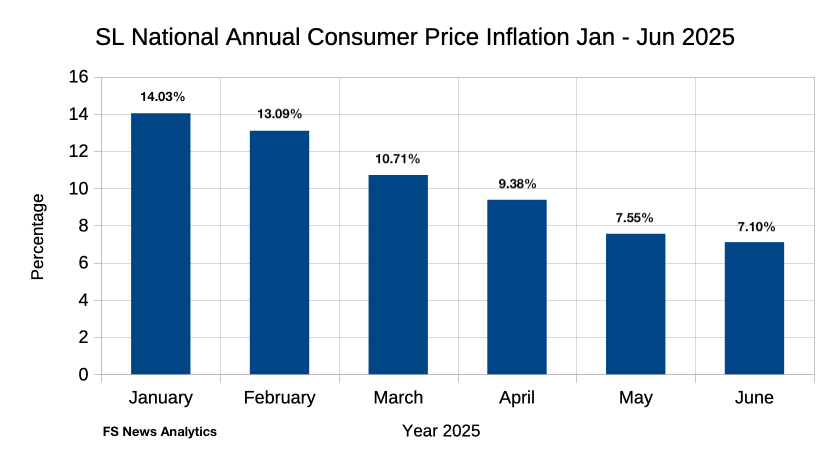

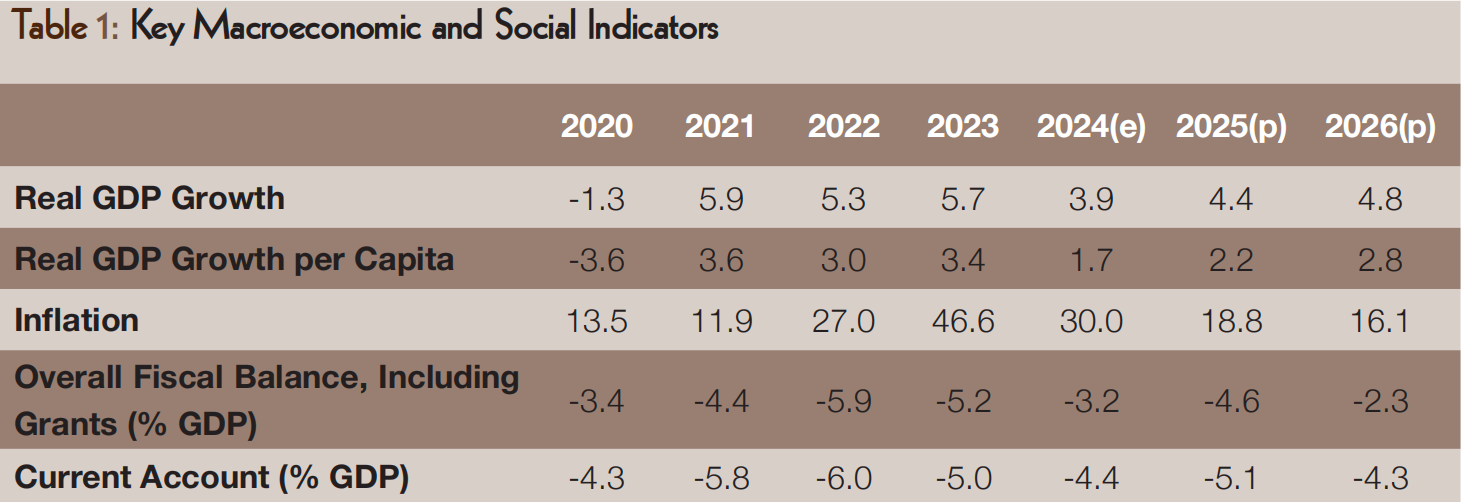

At the start of January, the exchange rate was approximately 22,400 SLL per USD. This progressive depreciation can primarily be attributed to persistent economic challenges, including high inflation rates, rising import costs, and a weakening of the local currency's purchasing power.

The data indicates a steady increase in the value of the dollar throughout the six-month period, with significant movements particularly observable in April. Between January and April, the exchange rate escalated sharply, reaching 22,900 SLL per USD.

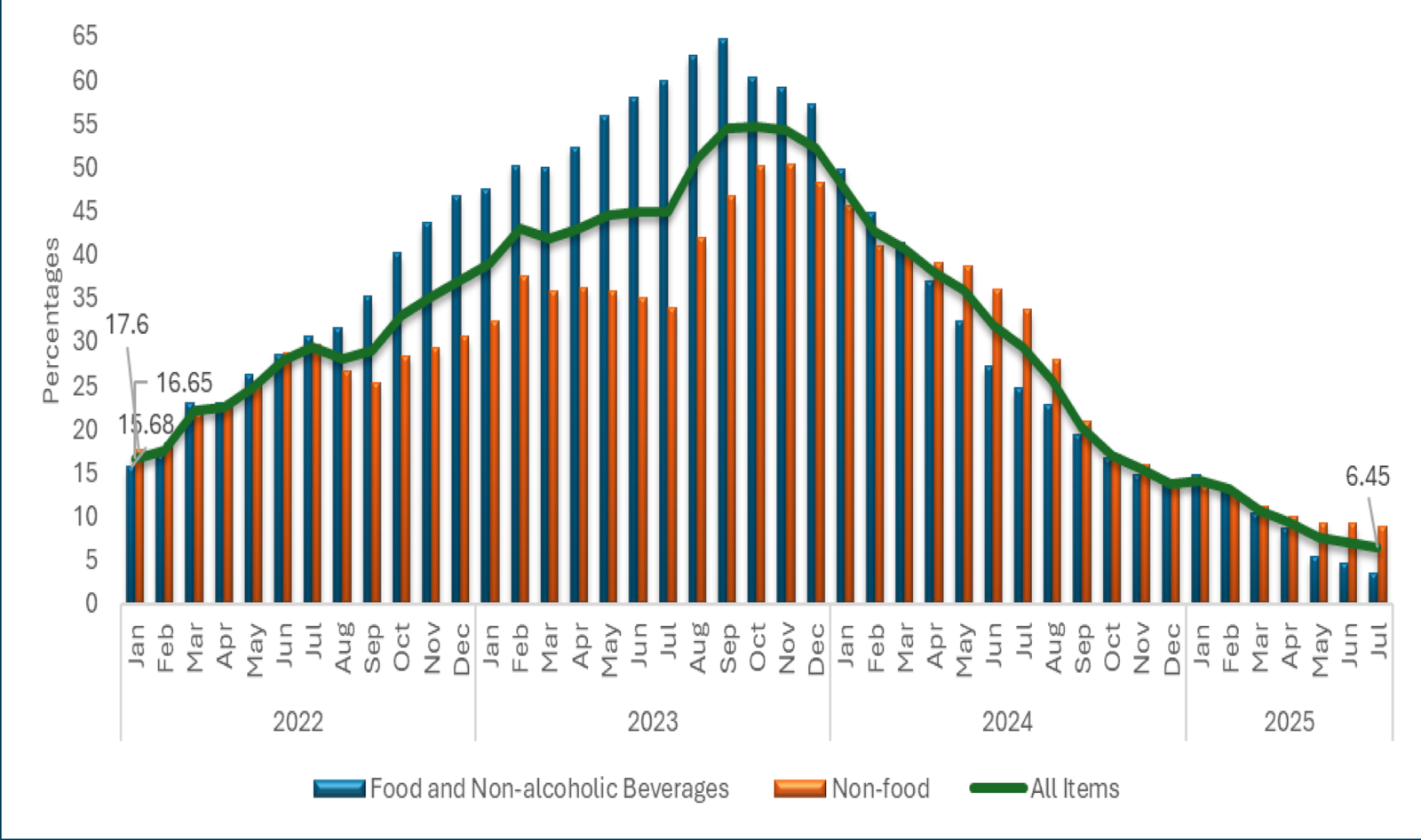

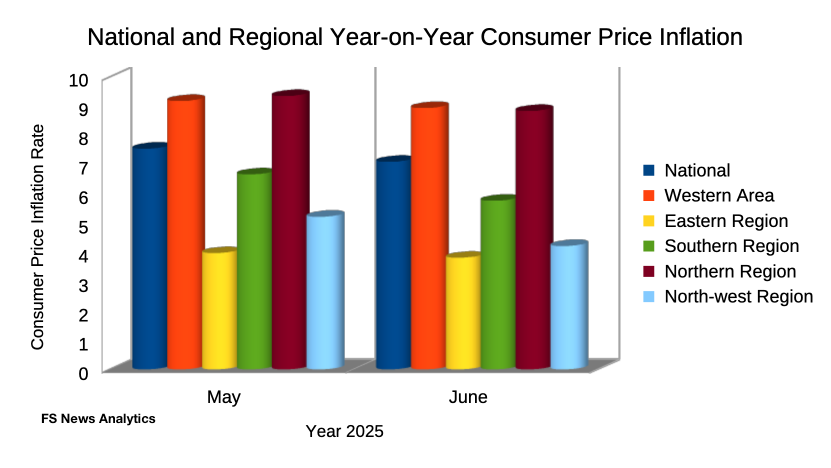

As of mid-2025, inflation has soared, which further eroding household purchasing power and complicating economic recovery efforts. The inflation has simultaneously affected the demand for foreign currency, resulting in increased pressure on the Leone.

Moreover, with out-of-pocket health expenses constituting more than 50 percent of total health expenditures and the government spending only eight percent of its budget on health, the economic landscape remains precarious. This financial tightrope adds to the uncertainty surrounding currency exchange.

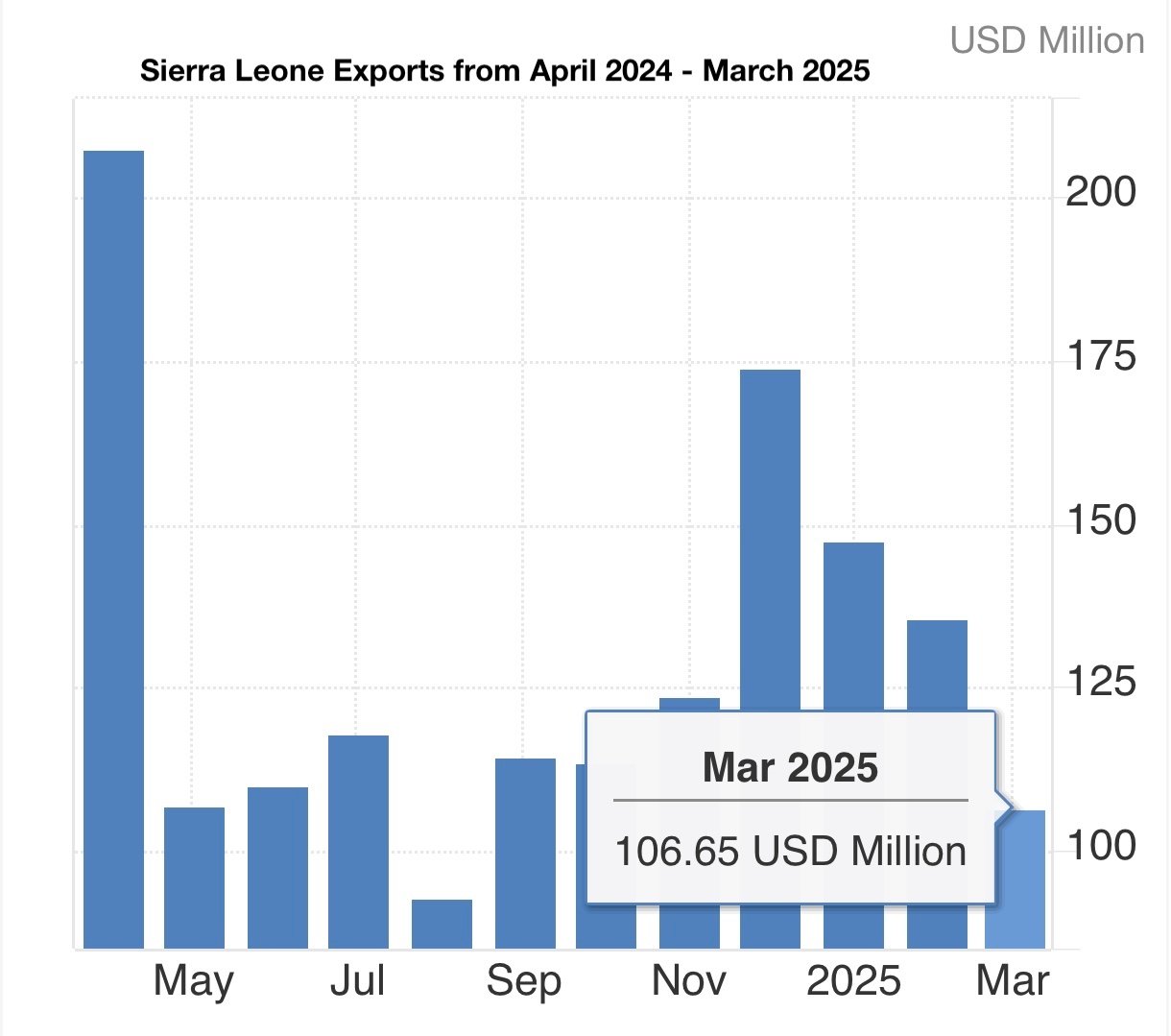

As noted from Trading Economics, the correlation between Sierra Leone’s domestic policies and the performance of its currency is evident. With most of the funding for development projects and infrastructure improvements not yet visible at the grassroots level, investor confidence remains tenuous.

Any delays in the implementation of economic reforms, alongside the associated fiscal constraints faced by the government, exacerbate the instability of the Leone against the backdrop of the dollar.