AfDB outlines macroeconomic roadmap for Sierra Leone

The African Development Bank (AfDB) has outlined a comprehensive analysis of Sierra Leone’s macroeconomic performance and outlook, shedding light on prospects for growth, the challenges ahead, and the critical steps needed to galvanize economic development.

The bank recommend a sustained focus on fiscal consolidation, as public debt remains at a manageable 46.5 percent of GDP, as the risk of debt distress looms large.

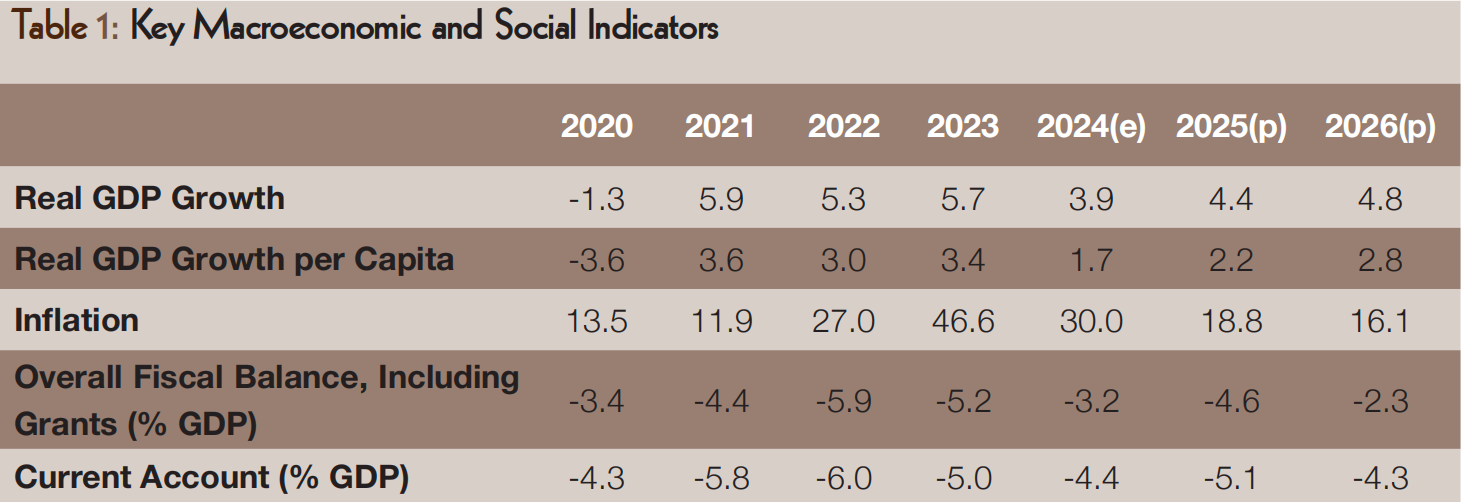

The outlook Is cautiously optimistic, with projected real GDP growth of 4.4 percent in 2025 and 4.8 percent in 2026. This growth is anticipated to be fuelled by sectors such as services, mining, and agriculture, supported by increased investments and consumer spending.

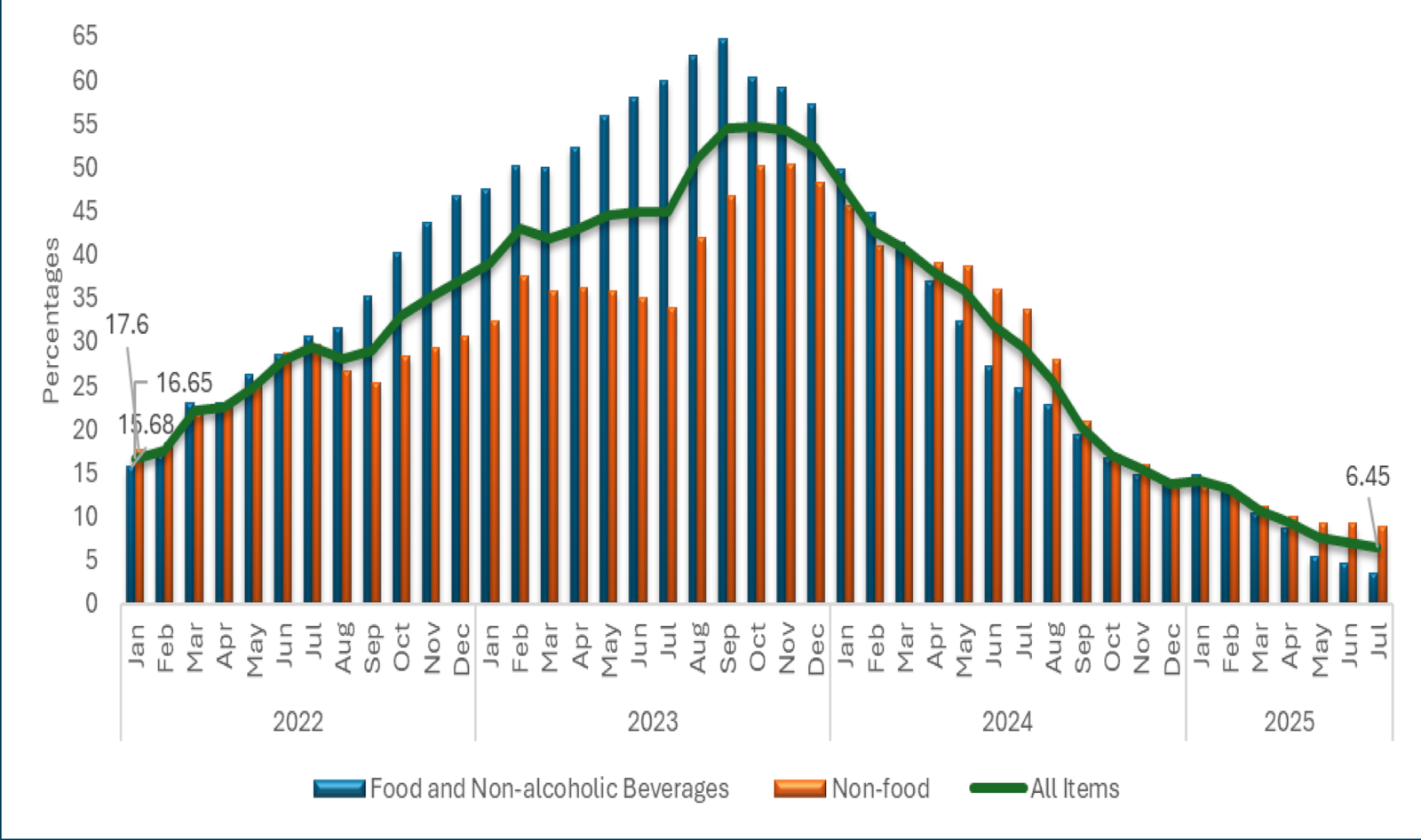

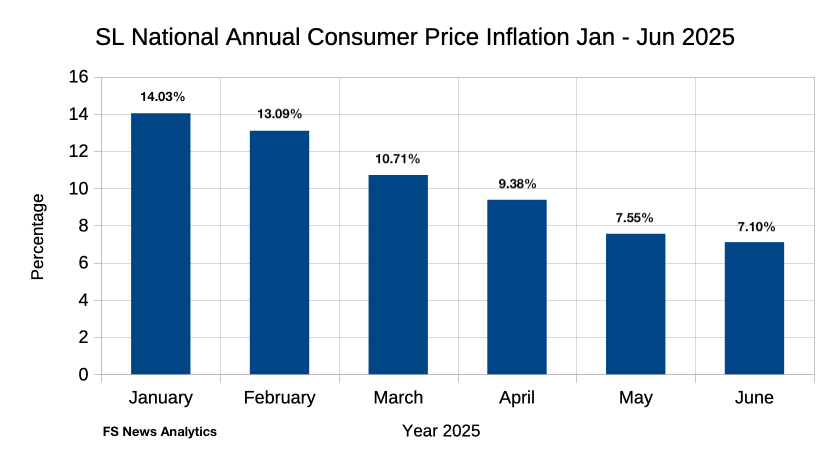

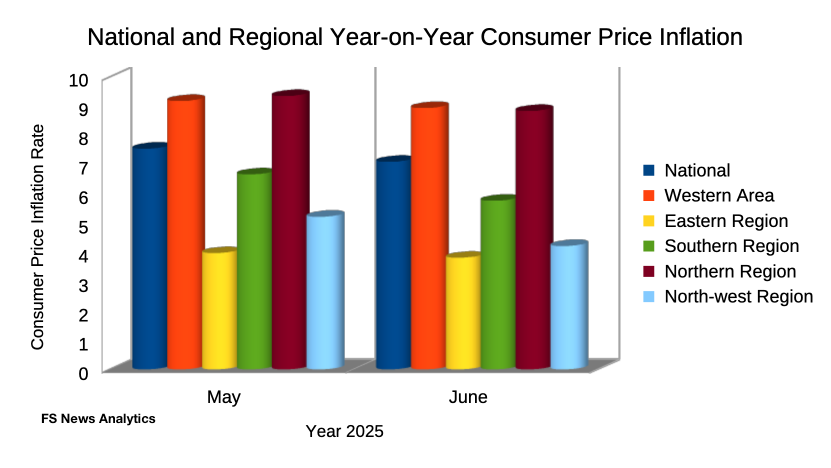

The report highlights a positive shift, with inflation decreased significantly from 47 percent in 2023 to 30% in 2024, owing to a stable exchange rate and tight monetary policies. These measures have contributed to a narrowing fiscal deficit, now at 3.2 percent of GDP, marking progress facilitated by improved revenue performance and prudent expenditure management.

However, it detailed that Sierra Leone faces profound financing challenges, complicated by limited fiscal space and structural bottlenecks that inhibit private capital mobilization.

The economy, primarily driven by the informal sector and heavily dependent on natural resources, finds itself vulnerable to external shocks, particularly as its agricultural base confronts climate change risks. High poverty rates overshadow economic progress, with a staggering GDP per capita of just USD 857 in 2024, leaving over half the population living below the poverty line.The AfDB's document underscores the urgent need for Sierra Leone to enhance fiscal efficiency and improve the business environment to spur private sector growth. Governance challenges, stemming from weak institutions and a fragmented legal framework, hinder effective capital mobilization and utilization. Tackling corruption and reducing illicit financial flows (IFFs) are essential steps toward unlocking the nation's potential, particularly in its rich natural resource sector.

The financial sector detailed by AfDB is characterized by a dearth of development, predominantly made up of commercial banks, which hold over two-thirds of financial assets. Despite this, the banking sector’s sound capitalization and profitability reflect its reliance on government securities rather than broad-based private sector engagement. Initiatives to increase financial inclusivity and stimulate lending to underserved sectors will be crucial for sustainable growth.

Sierra Leone’s economic future hinges on implementing transformative policy measures addressing tax collection, enhancing infrastructure, and investing in human capital development, the report highlighted.

The government, the bank notes, must prioritize innovative strategies to tap into domestic resources and diversify its revenue streams, ensuring that natural resource wealth translates into tangible benefits for all citizens.

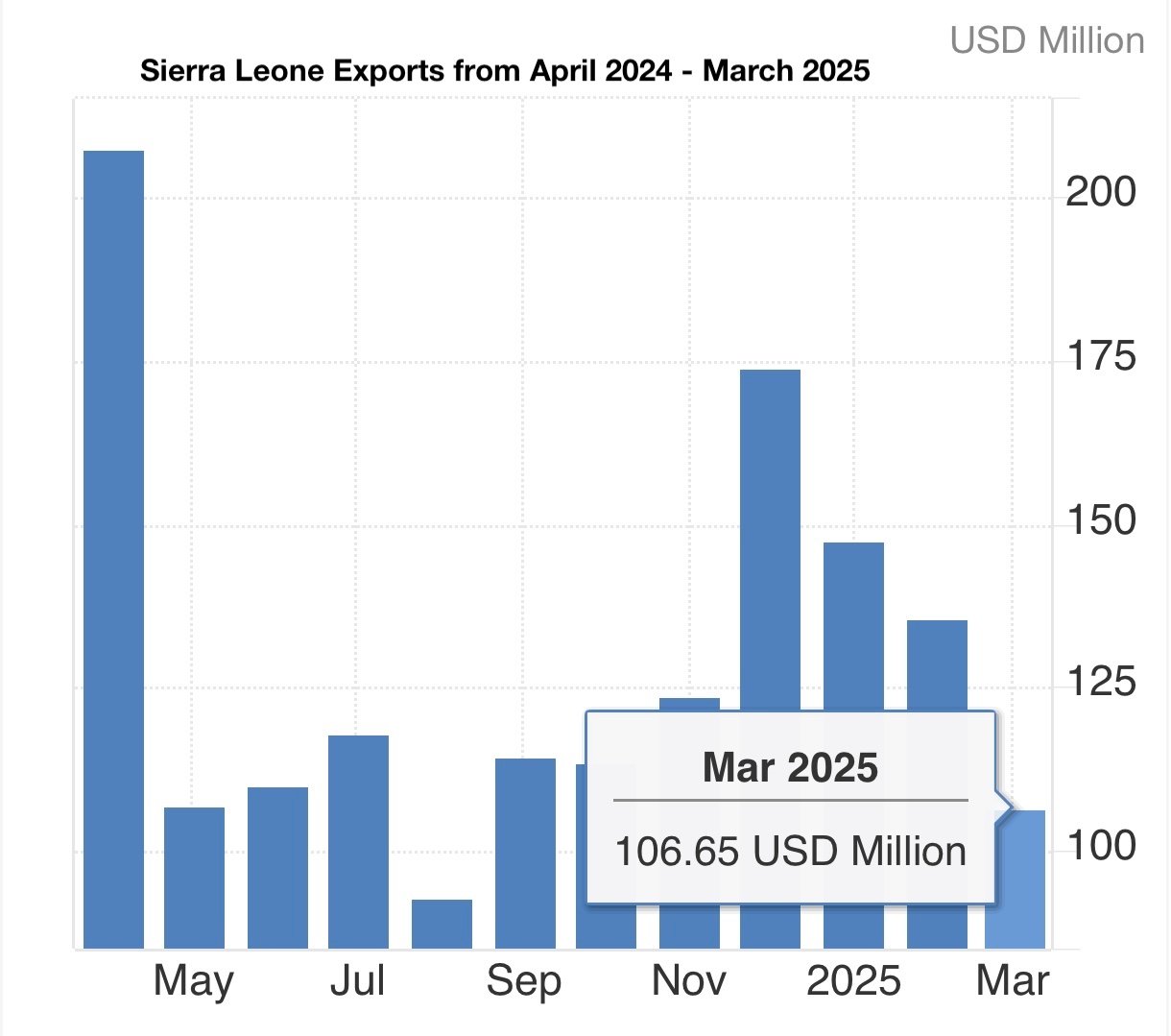

The AfDB also recommends targeted investments in health and education to bolster human capital, imperative for unlocking the nation’s economic potential. As the country’s dependency on mineral exports offers both a challenge and an opportunity for growth, stressing the importance of diversifying the economy.

The roadmap has the potential for Sierra Leone to leverage its abundant resources into a dynamic economy—if it can effectively address its governance challenges and foster a more conducive environment for investment and enterprise development.