US agric export to Sierra Leone decline in 2024

Sierra Leone’s trade relations with the United States in 2024 was a complex landscape marked by declining agricultural export figures and a challenging growth trajectory.

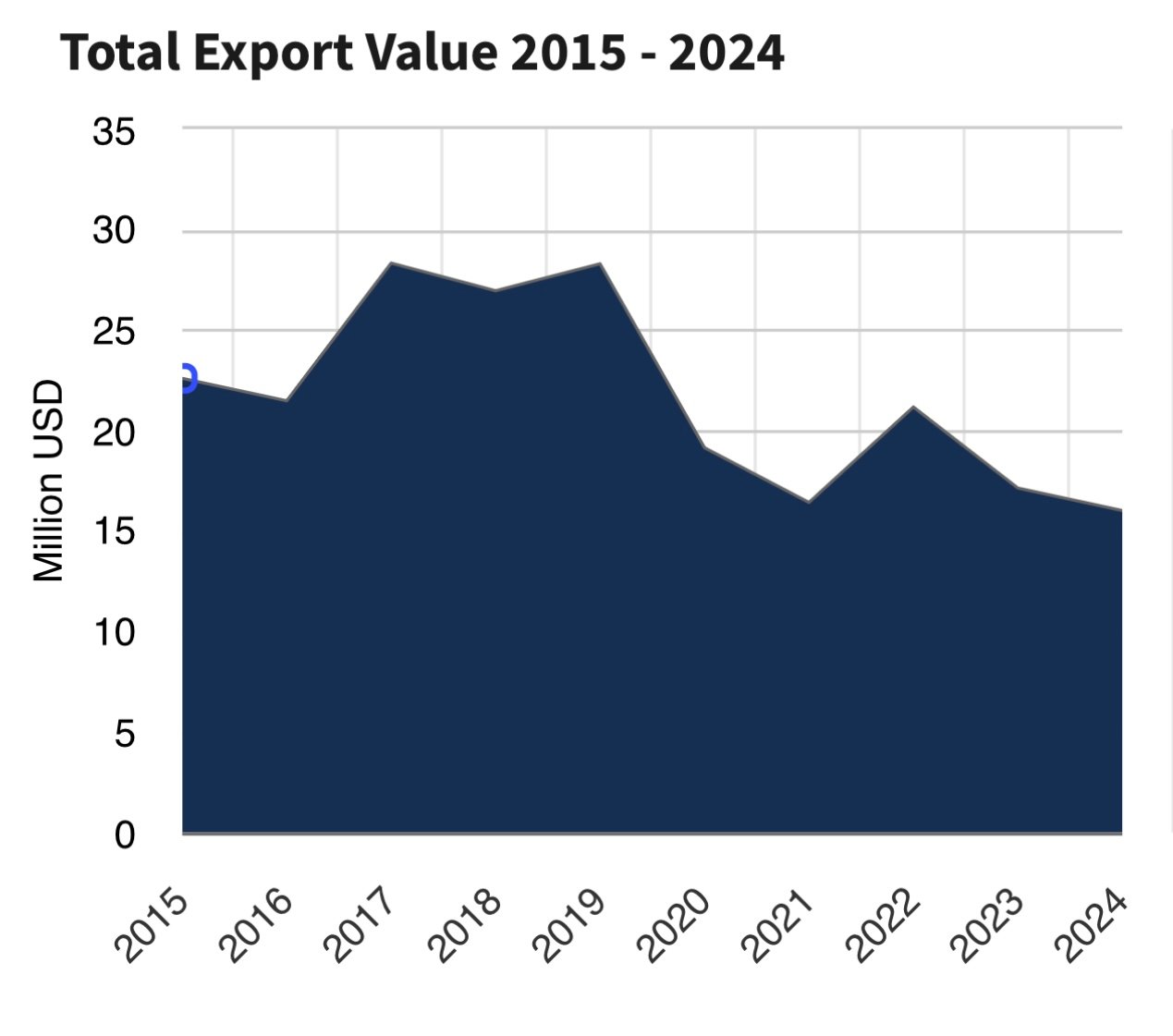

According to data from the U.S. Department of Agriculture (USDA), as of 2024 Sierra Leone ranked 116 among U.S. agricultural export markets, with a total export value of $16.02 million, reflecting a significant decrease from earlier years.

Over the past four years, the trend has been concerning. The three-year average stands at $18.11 million, underscoring a downward movement with a compound average growth rate of -3.38 percent from 2015 to 2024.

This trend indicates increasing challenges for U.S. exports to Sierra Leone, particularly in an evolving global trade environment.

In 2024, the commodities flowing from the U.S. to Sierra Leone largely centred on agricultural products. Poultry meat and products constituted the most significant share, with a total value of $12 million – excluding eggs, making up approximately 75 percent of the total exports. This reliance on poultry reflects Sierra Leone’s increasing demand for affordable protein sources, particularly given its domestic agricultural challenges.

Food preparations followed as the second-largest category, generating $1.11 million in exports. Beef and beef products contributed nearly $540,000, while rice an essential staple, accounted for approximately $474,920.

Additional products, such as distilled spirits ($323,858) and vegetable oils (excluding soybean) ($261,308), rounded out the top ten exports to the West African nation.

Despite these contributions, the overall decline in U.S. export values raises critical questions. A consistent drop in the compound annual growth rate suggests that U.S. products face stiff competition from other international suppliers, possibly due to price, availability, or other market dynamics.

Rice is also a key product imported from countries such as India and Vietnam, which might have advantages in pricing or logistical efficiencies that result in higher market shares in Sierra Leone compared to U.S. products.

Moreover, the graph illustrating total export values from 2015 to 2024 showcases notable fluctuations rising to peaks, such as in 2019, although failing to achieve substantial consistency over the past few years. This inconsistency must be addressed through strategic trade policies that enhance competitiveness, support increased production, and forge stronger partnerships with local stakeholders.

The ongoing need for diversified agricultural imports creates avenues for collaboration, innovation, and investment, as the U.S. adapt its trade strategies to capitalize on potential growth areas.

While U.S. exports to Sierra Leone held considerable value in 2024, the enduring downward trend demands urgent attention from policymakers and businesses alike. Implementing strategies to boost trade efficiency, enhance product positioning, and improve collaboration with local partners will be essential to regain momentum in this vital export market.

The focus must be on a resilient recovery pathway that not only stabilizes trade relations but also positions both nations for improved economic outcomes in the future.