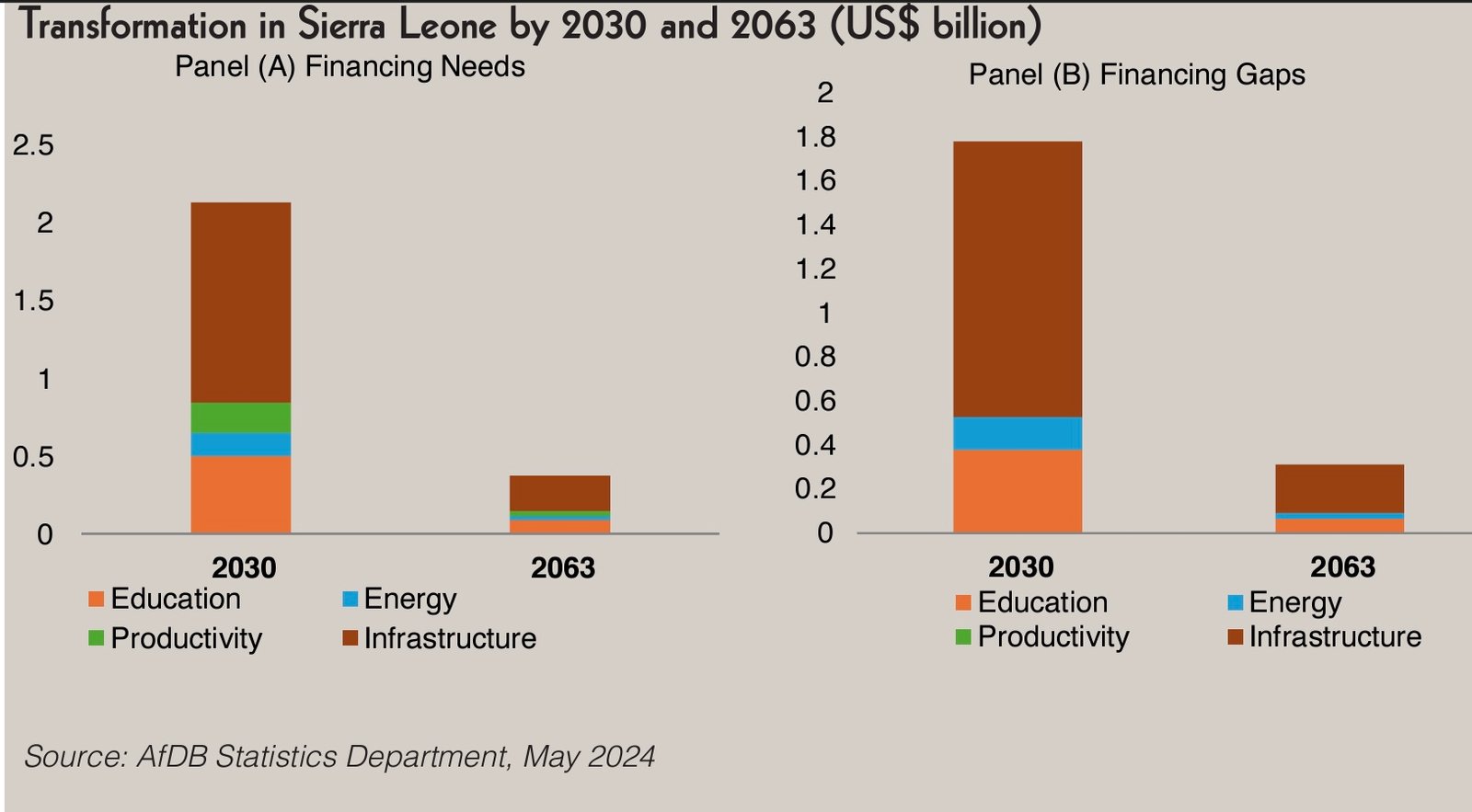

Diaspora Remittances Account for 8.4% of GDP

Diaspora Remmittance Graph 2018 - 2023

Diaspora Remmittance Graph 2018 - 2023

Diaspora remittaces have continued to contribute significantly to the Gross Domestic Product of the country. Latest figures revealed it accounted for approximately 8.4% of Sierra Leone’s GDP in the 5-year period to 2023.

This significant development underscores a crucial role in financial stability for many households across the country. Remittances do not only provide immediate financial relief but also help in poverty reduction, enhancement of social stability, while it also bolster local consumption.

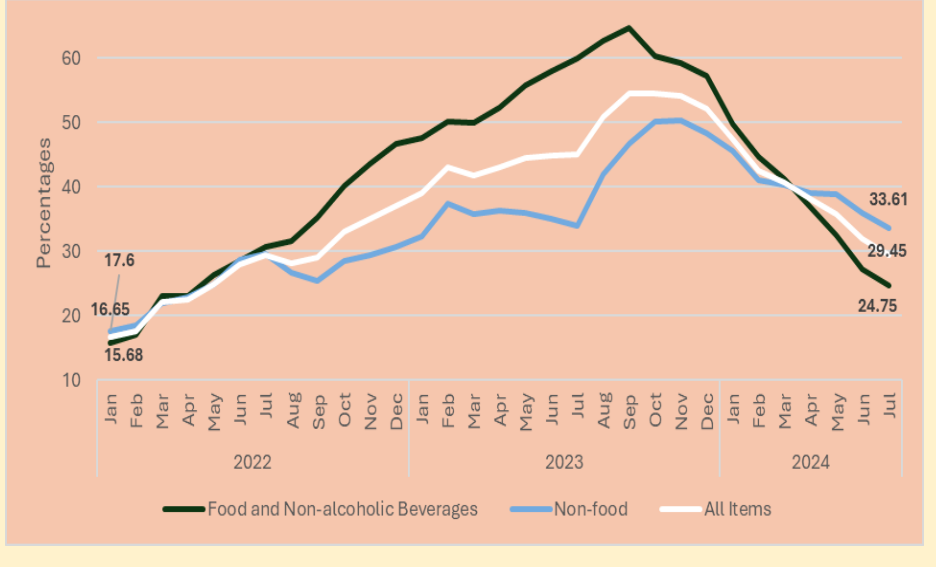

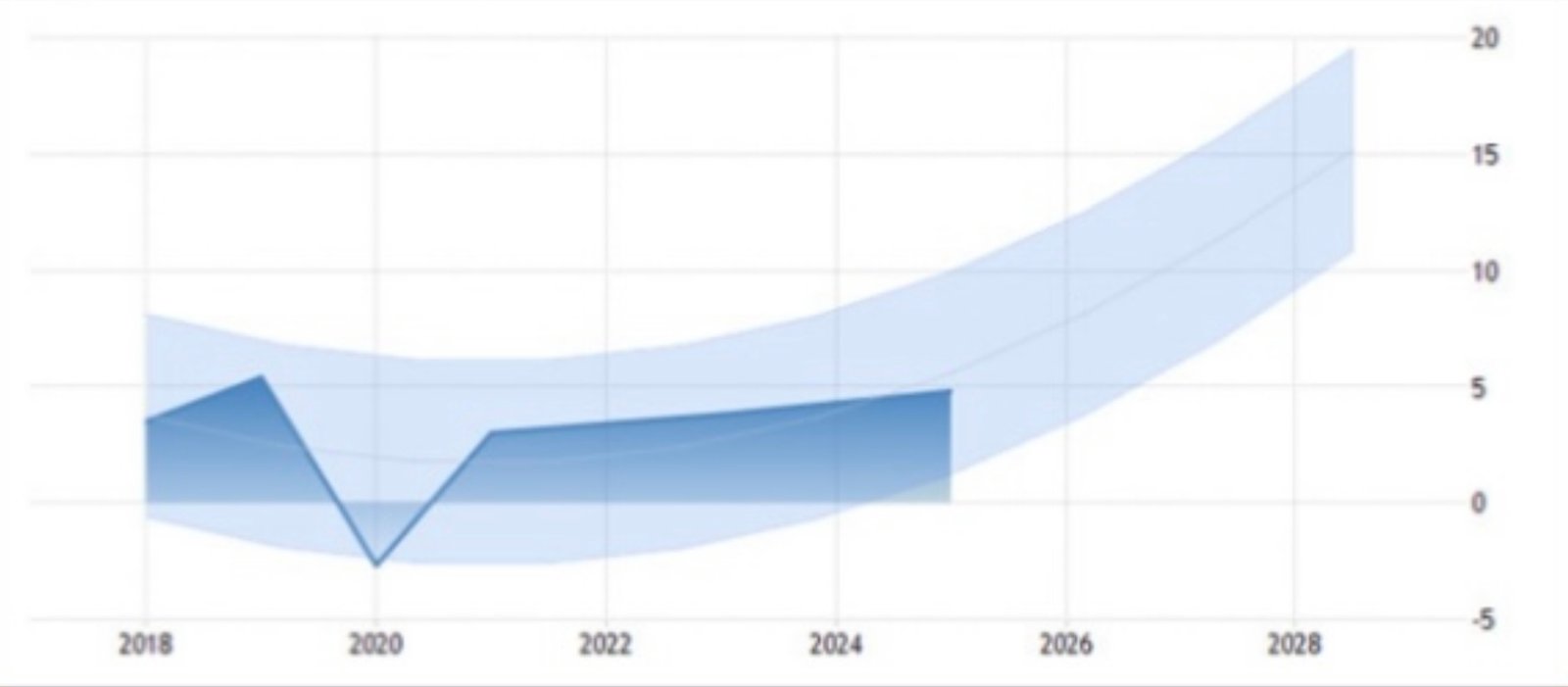

Recent data released by the International Monetary Fund (IMF) revealed significant growth in the past 5 years as a proportion of the nation's GDP, showcasing the importance of this financial lifeline. The surge has seen a remarkable upward trend over the past years, as personal remittances for 2018 were a modest 1.8% of GDP, which ascend to 4.4% of GDP in 2019, a 2.6% growth. The figure remained stable at 4.4% in 2020 despite challenges posed by the pandemic, reflecting the resilience of the diaspora in supporting families and doing their businesses.

An increase of 1.1% of GDP reaching 5.5% in 2021 as the global economy began to recover and diaspora communities expanded their support. A testament to the critical role these funds play in local economies, 2022 recorded 7.9% of GDP, with the trend further accelerated, culminating in remittances constituting an impressive 8.4% of GDP in 2023.

As country look ahead in the last quarter of 2024, FS analysts projected that personal remittances are likely to maintain their growth trajectory, buoyed by several factors. The global economy is expected to continue improving, which could lead to higher earnings for the diaspora, further increasing their ability to send money home.

Economic experts foreseen that personal remittances may experience slight growth of approximately 9.0% of GDP in 2024. This optimistic forecast is supported by a growing recognition of the necessity for financial support among expatriates, as well as favourable exchange rates and improved access to remittance services.

The government has been making strides to improve the business environment and attract more remittance inflows. Policy measures aimed at easing restrictions on cross-border money transfers are expected to further facilitate this growth. Initiatives aimed at fostering better financial services, encouraging investment of remittances in local industries, and attracting investment from the diaspora are anticipated to further enhance the flow of remittances.

The increasing dependency on remittances as a lifeline highlights not only the importance of the diaspora but also the vulnerabilities of the local economy. With the percentage of personal remittances projected to reach 9.0% of GDP, stakeholders must consider strategies to leverage these financial flows for sustainable economic development.

Several factors have contributed to the stability and increase of remittances to Sierra Leone in recent years. With diaspora engagement remains actively in supporting back home, economic conditions and the rise of digital financial services and mobile money platforms has made sending remittances more accessible and cost-effective. Lower transaction fees and enhanced convenience have encouraged more people to partake in this financial channel.

As the trend for personal remittances is ascending on a yearly basic, this will take a substantial impact on the overall economy, the potential for remittances to contribute even more to Sierra Leone's economic stability and growth is significant. Continued focus on facilitating these financial flows, alongside addressing the underlying economic challenges, will be crucial in sustaining this momentum.

While the outlook appears promising, challenges remain. Economic volatility in key remittance sending countries could impact the ability of diaspora families to continue sending money home. Additionally, fluctuating exchange rates and inflation could erode the purchasing power of remittances, impacting their effectiveness in driving economic benefits for recipients.

21-10-2024