Tourism & Travel

Investment

Banking & Finance

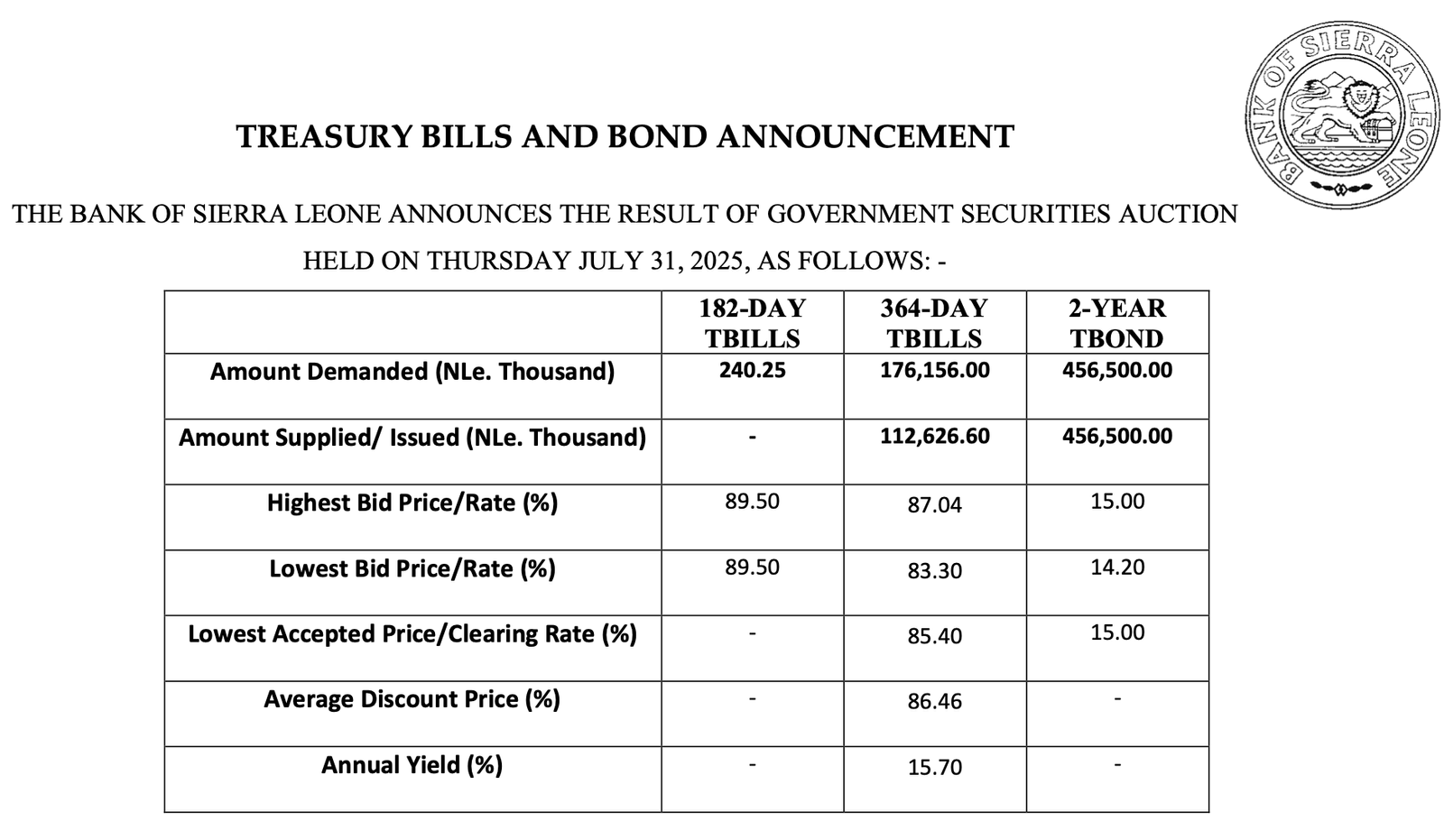

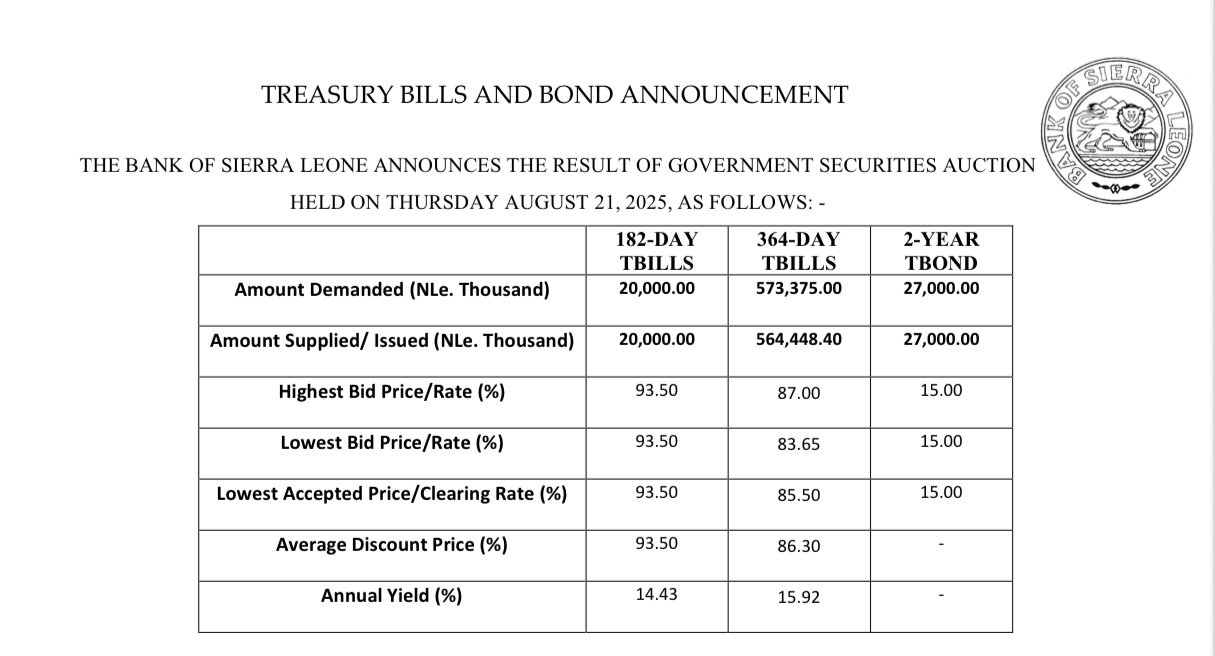

Government debt appetite remains strong, as yields inch up Ibrahim Mansaray Sep 06, 2025

BSL auction gains momentum as Investors demand more for T-Bills Ibrahim Mansaray Aug 29, 2025

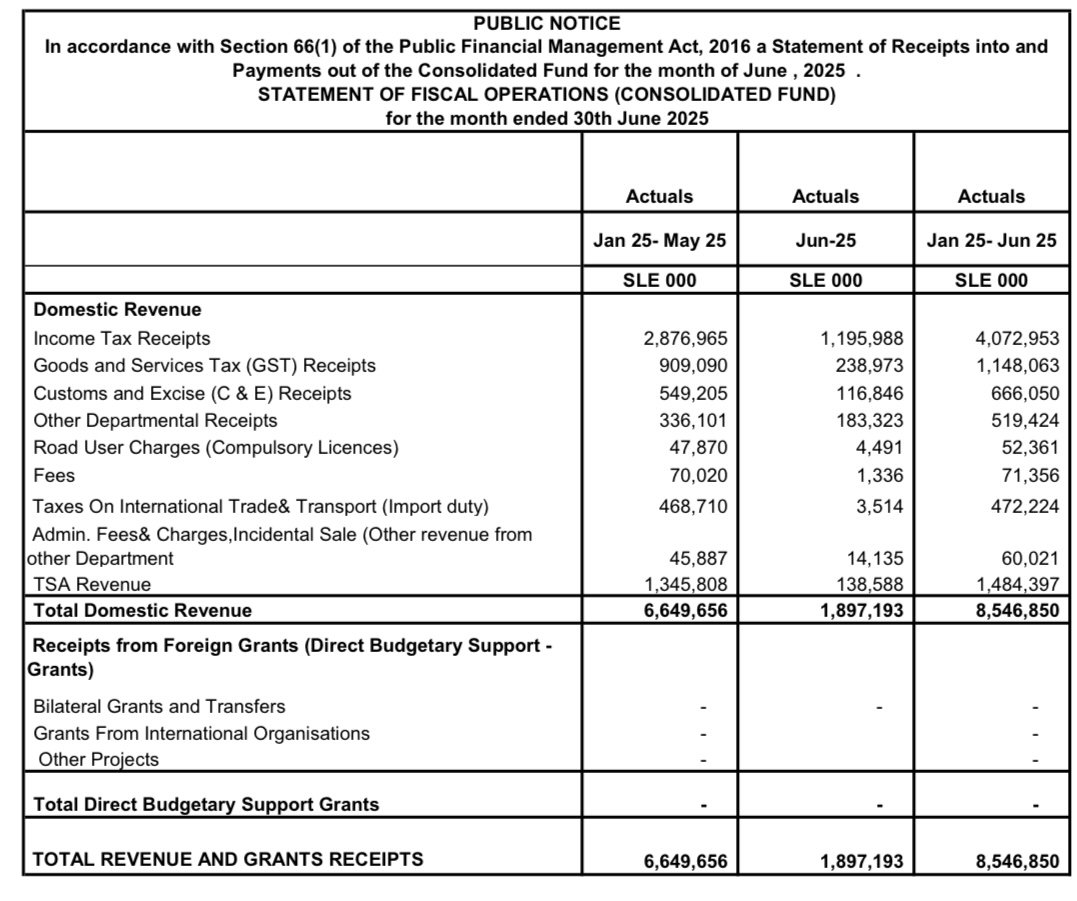

June fund outputs show healthy deficit management Aug 22, 2025

T-Bills demand soars as T-Bond falters in auction Aug 17, 2025

Investors Rally Treasury Bills At SLe316m Jul 21, 2025

UBA posts NLe 833.6m profit, expands customer base Jul 09, 2025

BSL Forex Midrate

| Dollar | Euro | Pounds | |

|---|---|---|---|

| (SLE) | 22.6263 | 26.4312 | 30.4765 |

Advertise Your Business

Parallel Market Rate

| (SLE) | Dollar | Euro | Pounds |

|---|---|---|---|

| BUY | 22.8124 | 26.5422 | 30.6426 |

Monetary Rates

| Monetary Policy Rates (MPR) | 21.75% |

| Standing Deposit Facility (SDF) | 14.25% |

| Standing Lending Facility (SLF) | 23.75% |

News

UNICEF, GPE Partnership Boost Early Education Sep 29, 2025

Youth Ignite Climate Tech Revolution Sep 29, 2025

Civic Engagement Drive Series Kicks Off in Makeni Sep 29, 2025

Sierra Leone ratifies AU road safety charter Sep 09, 2025

Corporate News

Enumerators map youths to drive creative economy Aug 26, 2025

AM Best upgrades outlook for WAICA to positive Aug 22, 2025

Tech

Statistics

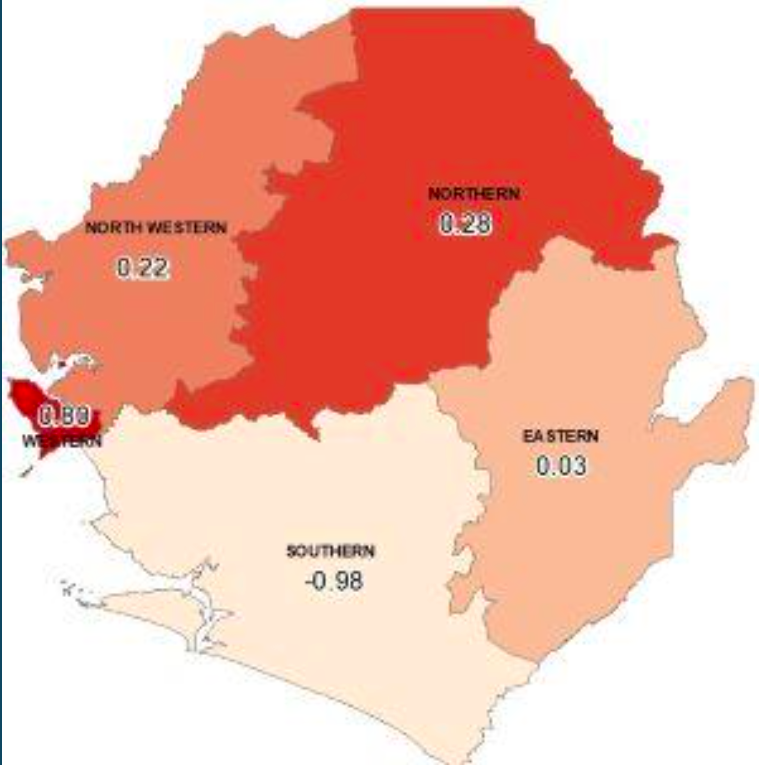

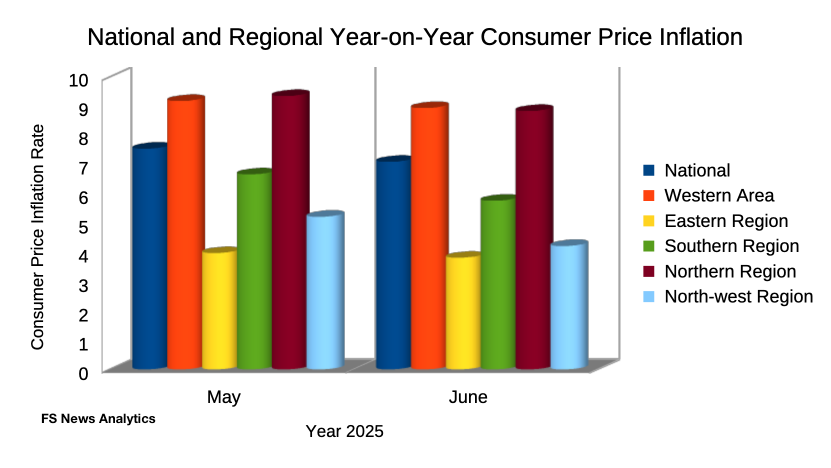

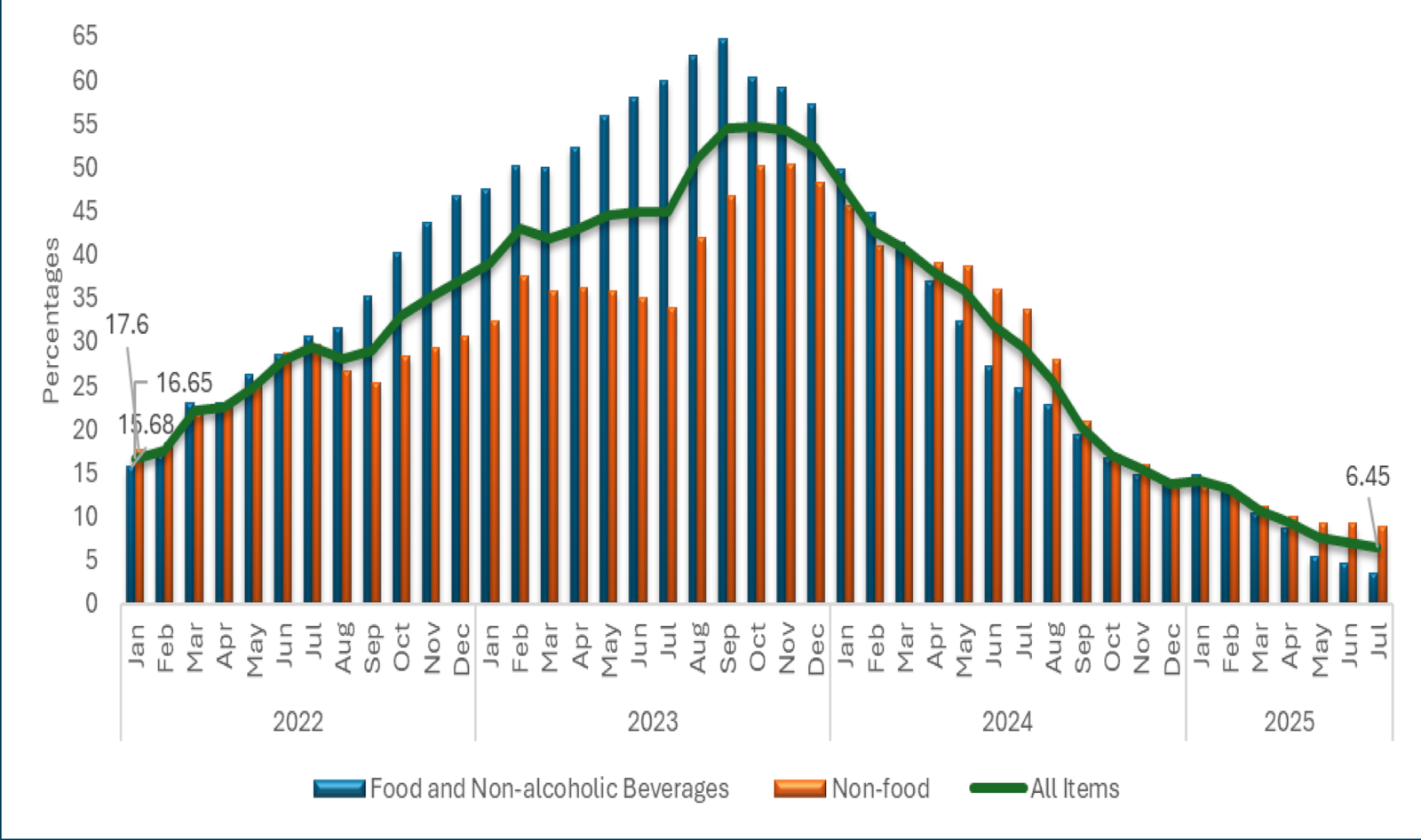

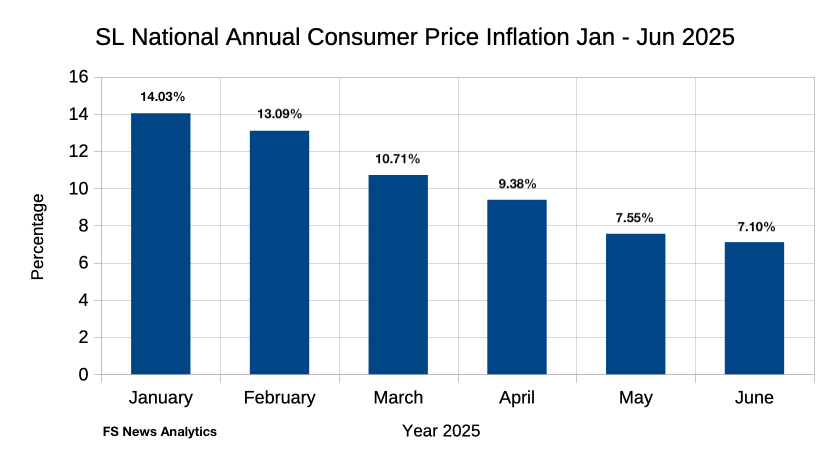

National CPI holds at 6.45% YoY in July as MoM edges up to 0.32% Ibrahim Mansaray Sep 02, 2025

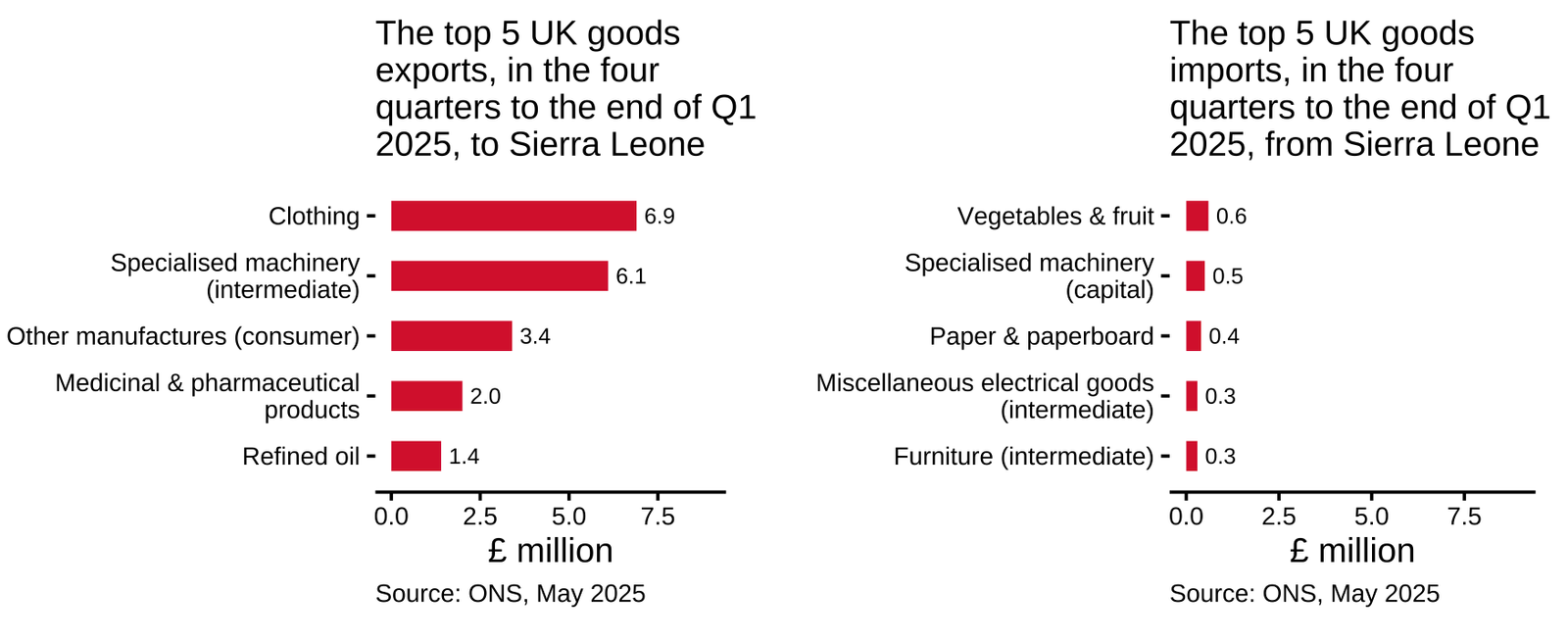

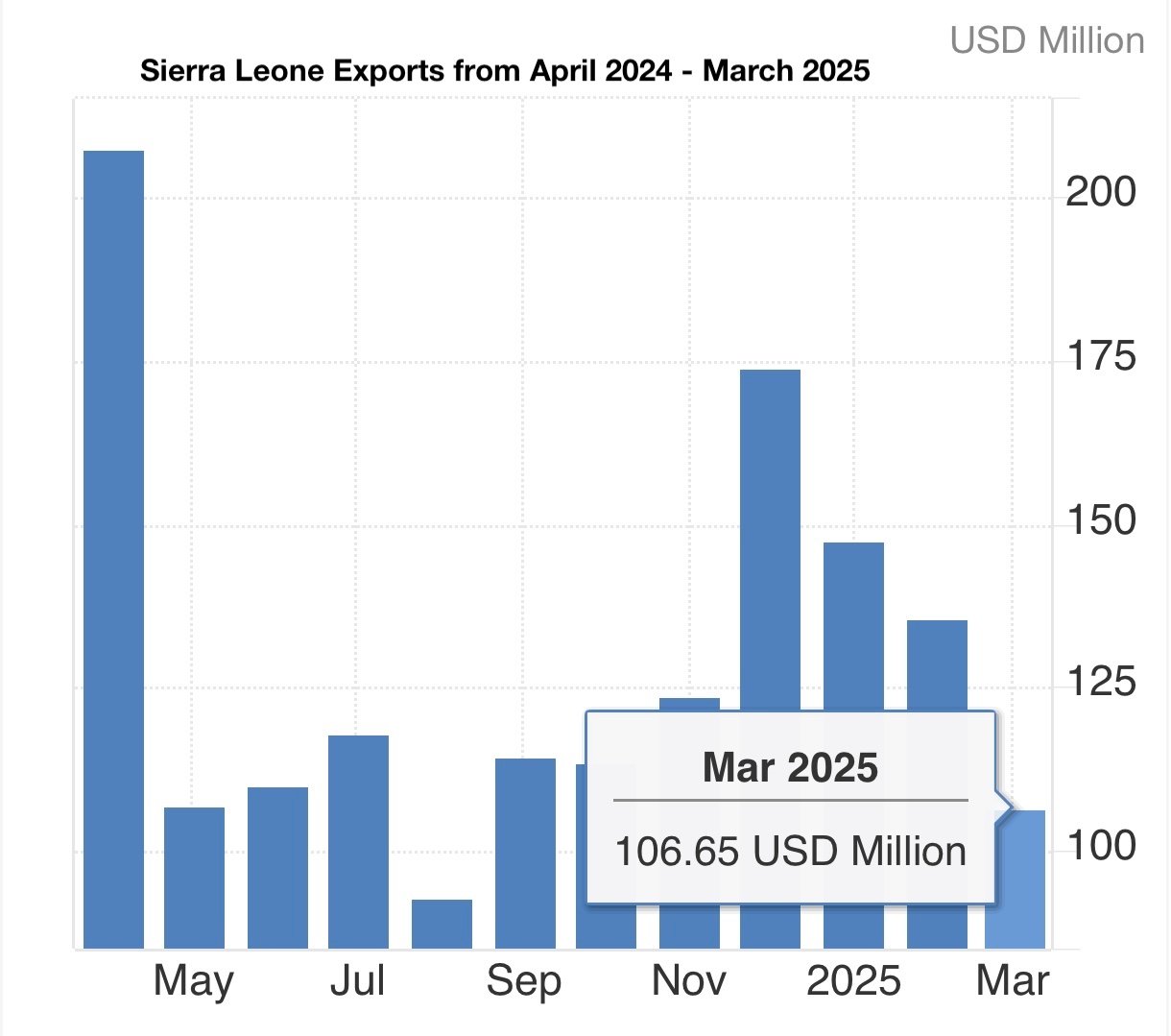

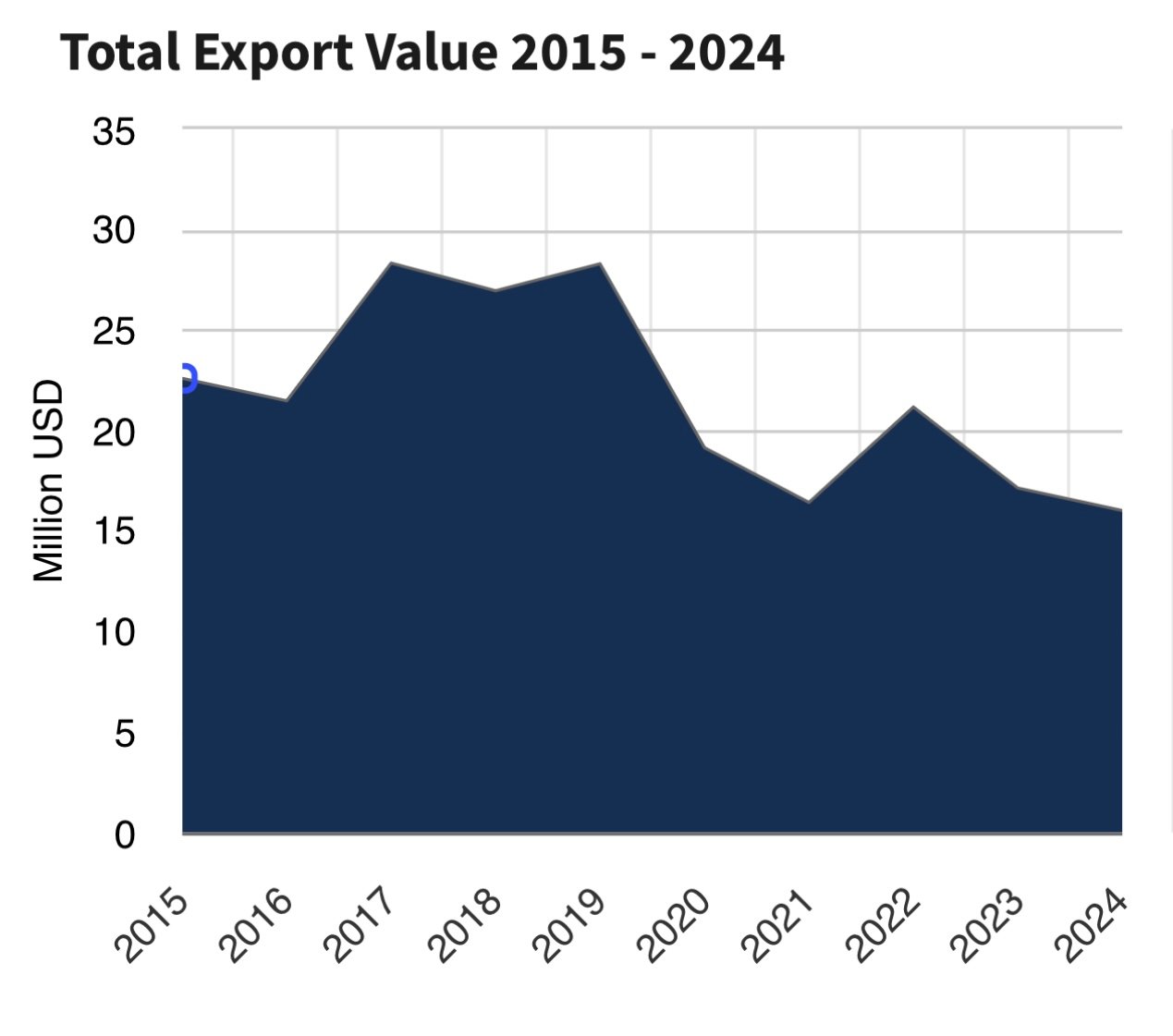

Export faces new challenges as trends shift south Aug 06, 2025

Annual CPI declines by 6.93% in first half of 2025 Jul 23, 2025

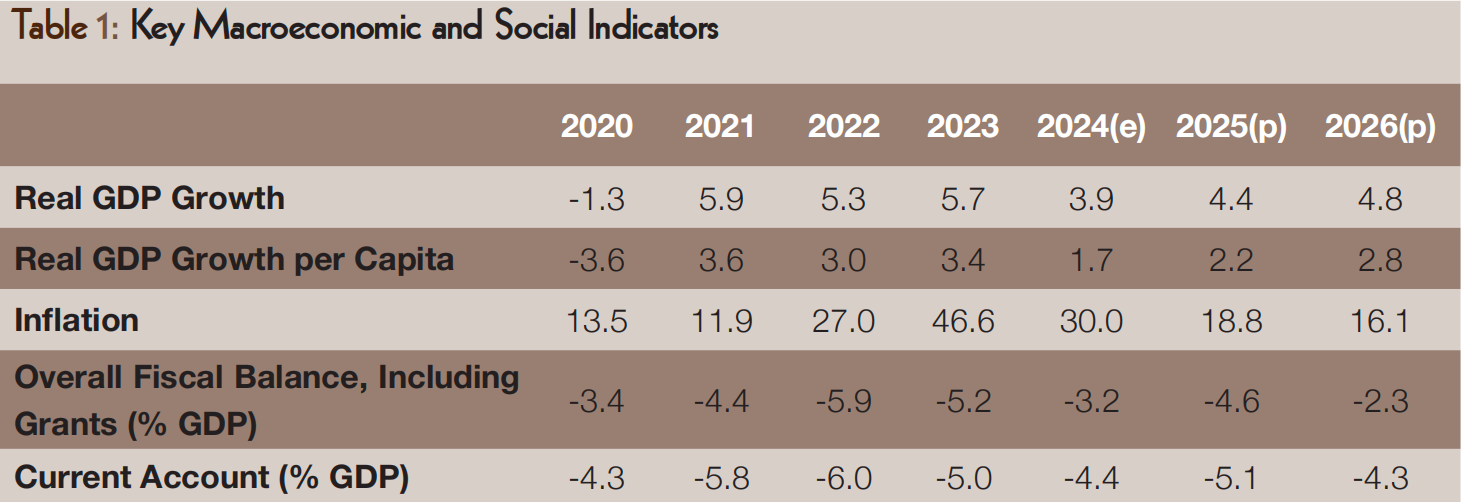

AfDB outlines macroeconomic roadmap for Sierra Leone Jul 18, 2025

Energy

U.S. approves $480m grant to boost energy sector Jul 26, 2025

Country Report

Execution Of New Criminal Procedure Act Begins Ibrahim Mansaray Sep 20, 2025

Salone charts course for sustainable migration management with NRR Ibrahim Mansaray Sep 09, 2025

Agric-Export

UN program boosts food security, rural economy in Sierra Leone Ibrahim Mansaray Aug 22, 2025

US agric export to Sierra Leone decline in 2024 Ibrahim Mansaray Aug 06, 2025

Much Ado About Rice Jan 13, 2025

Relief Works Intensify in Kambia District Dec 20, 2024

MoF Seeks $100m For Livestock Project Dec 20, 2024

Executive

Sierra Leone, UNDP Bond For Stability, Security Ibrahim Mansaray Sep 29, 2025

Sierra Leone Deepens Partnership With South-South Cooperation Ibrahim Mansaray Sep 20, 2025

Democracy Day Sparks Economic Optimism Ibrahim Mansaray Sep 20, 2025

Global mental health crisis affects over 1 billion people: WHO John Marah Sep 06, 2025

Environment

Coastal communities benefit from UN aid against climate chaos Ibrahim Mansaray Aug 22, 2025

Sierra Leone secures €9.5m boost for green growth Ibrahim Mansaray Aug 17, 2025

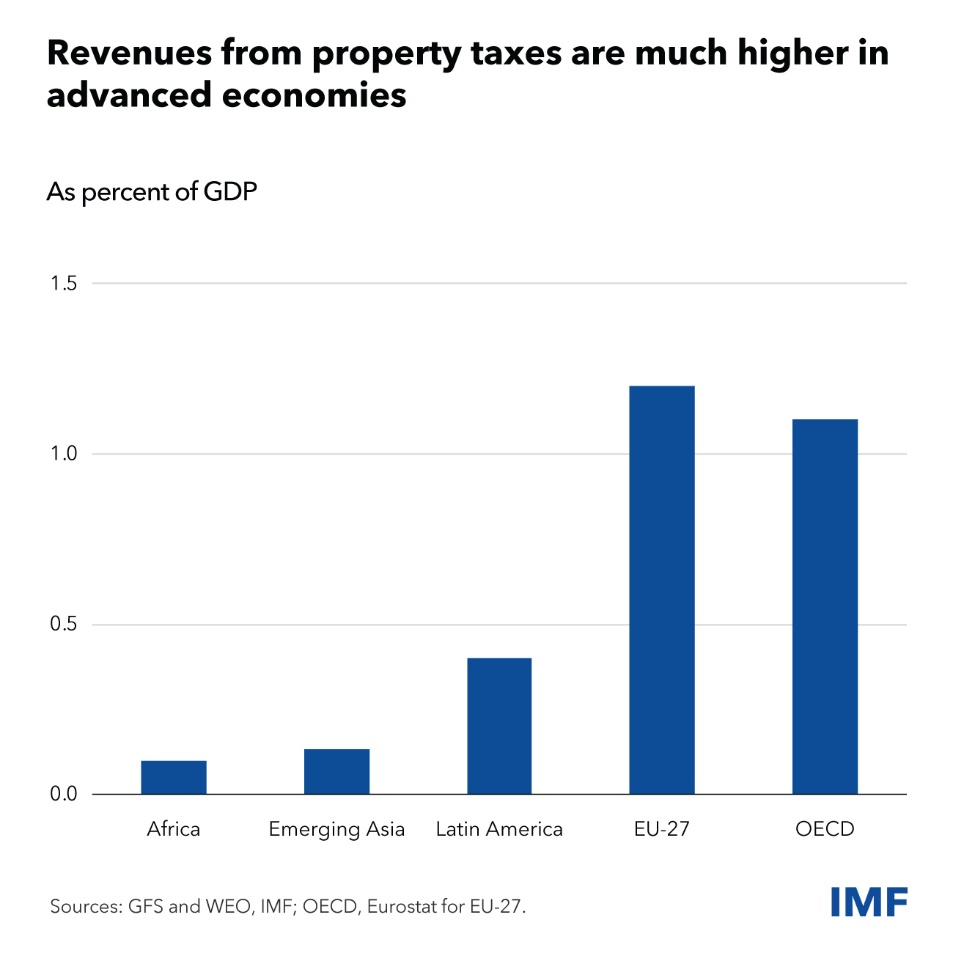

Real Estate

Housing Africa’s Growing Population Dec 31, 2024

Owning Homes is Becoming Unaffordable Dec 16, 2024

Why We Charge Rent In FX Oct 21, 2024

Health

S/Leone’s epidemic sleuths move to frontline, strengthening health security Ibrahim Mansaray Aug 26, 2025

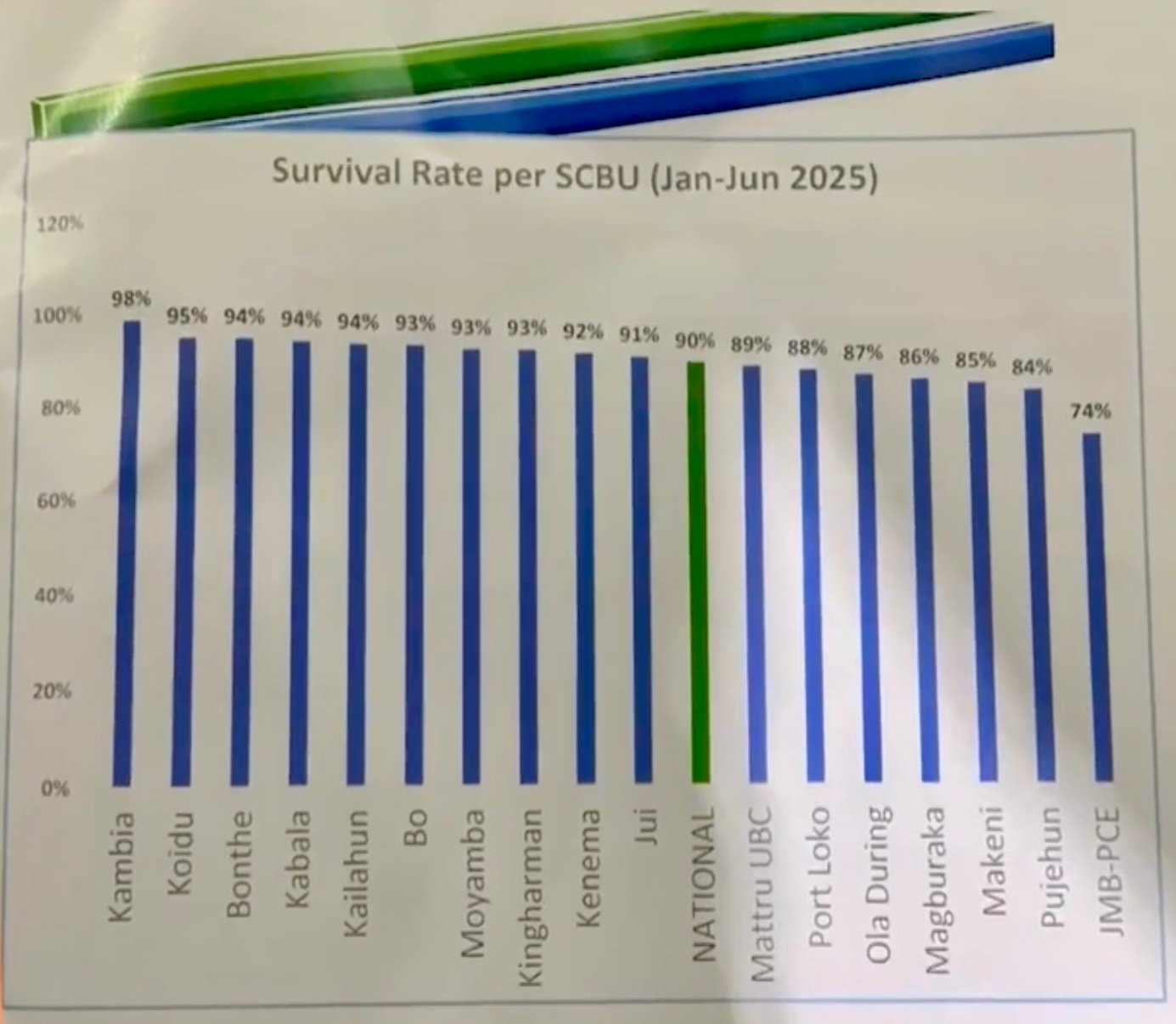

SCBUs Survival Rate Soar on Healthcare Investment Aug 22, 2025

Child Health Efforts Gain Momentum Aug 18, 2025

U.S. funds help Sierra Leone tame Mpox Aug 17, 2025