03/12/2024 Banking

Access Bank SL

Access Bank SL

The African Development Bank (AfDB) has approved a $4 million trade finance transaction guarantee for Access Bank Sierra Leone Limited (ABSL). This initiative seeks to empower local businesses.

The facility would specially benefit Small and Medum scale Enterprises (SMEs) and women-led enterprises in the economy. FS was hinted that the facility would bridge financing gaps and facilitate international trade engagements.

The guarantee being provided by the AfDB, FS learnt, is rated AAA and is offering comprehensive coverage to international confirming banks against non-payment risks associated with ABSL's trade finance transactions. This assurance, FS sources stated will enable ABSL to finance key imports of consumer goods particularly essential food items like rice, cereals, and cooking oil—that are fundamental to the country’s value chain. By supporting these transactions, the facility is projected to facilitate approximately $36 million in trade over the next three years, promoting significant economic activity within the country.

Lamin Drammeh, Head of Trade Finance at the AfDB, highlighted the transformative potential of this facility for the private sector in Sierra Leone. He stated, "By addressing critical financing gaps, we're enabling SMEs to participate more actively in regional and global trade, ultimately contributing to job creation and improved livelihoods." This sentiment underscores the growing recognition of SMEs as vital players in achieving sustainable economic growth and job creation, which is still in a transitional phase as it strives for economic stability and development. The imperative to enhance intra-African trade is more relevant than ever, particularly in the context of the African Continental Free Trade Area (AfCFTA), which aims to create a single market for goods and services across the continent. This trade finance guarantee aligns with the AfCFTA's objective by facilitating trade transactions that can spur regional economic integration and development.

The Managing Director at ABSL, Ganiyu Sanni expressed optimism about the potential impacts of the guarantee, stating, "This AAA-rated guarantee will help the bank to grow their trade finance book and support Sierra Leone. Particularly, it will support our issuances of trade finance transactions in critical sectors such as agribusiness (importation of strategic soft commodities) and trading of intermediate goods." His comments reflect a strategic focus on bolstering essential sectors that can drive economic resilience and sustainability in Sierra Leone.

This Transaction Guarantee is part of the AfDB's broader strategy to support trade finance across Africa. It was launched back in 2021, this facility designed specifically for local banks, providing a much-needed safety net in the complex landscape of international trade. By covering a variety of trade finance instruments—including confirmed letters of credit, trade loans, irrevocable reimbursement undertakings, and other bills, the AfDB intent is to mitigate the risks often associated with lending and trade.

For letter of credit (L/C) issuing banks, the facility offers significant advantages. Many such banks often find themselves constrained by cash margins required for their L/Cs or have exhausted their confirmation lines with correspondent banks. This instrument alleviates those challenges, allowing banks that meet AfDB's due diligence to participate, thereby improving their capacity to support local importers and exporters. Moreover, the AfDB also extends 3.5-year trade finance lines of credit to local banks, further enhancing their ability to mobilize capital for trade. This suite of financial instruments not only empowers banks but also catalyzes growth in strategic sectors of the economy, particularly commercial enterprise, which is crucial for food security in Sierra Leone.

With $4 million trade finance guarantee to ABSL—means to support SMEs and foster international trade, this initiative promises to enhance job creation, economic diversification, and overall socio-economic development in the country. Such strategic interventions are essential for building resilient local economies capable of thriving in an increasingly integrated and competitive world.

By Joshua Mans

03/12/2024 Agric-Export

Women doing rice cultivation

Women doing rice cultivation

The African Development Fund (ADF) has recently approved an initial funding package of $99.16 million aimed at enhancing rice cultivation value chains in West Africa. This initiative forms part of the broader Regional West Africa Rice Development project, which seeks to tackle food security challenges while promoting self-sufficiency in rice production across the region by the year 2030.

With Gambia and Guinea-Bissau as initial beneficiaries, questions arise on the immediate implications for Sierra Leone’s agricultural sector especially the state’s Feed Salone Initiative. The take-off of this regional agricultural project holds promises for future funding opportunities for Sierra Leone. As the project progresses and proves its efficacy, Sierra Leone could find eligibility for subsequent phases of funding, aimed at scaling similar initiatives.

With access to innovations and best practices, rice producers in the country can adopt innovative cultivation techniques and value addition methods disseminated through regional collaboration efforts, spearheaded by Africa Rice and ECOWAS. Knowledge-sharing platforms can facilitate learning and improve productivity in Sierra Leone’s rice farming practices.

As the public and private investment strategies being encouraged, the country could see a surge in investments from agribusiness firms looking to participate in improving rice production and distribution. This heightened interest can catalyse local market growth and improve infrastructure critical for rice value chain enhancement.

The ADF initiative have promoted regional integration, beneficial for Sierra Leone as it seeks to strengthen intra-regional trade networks, providing local producers with access to wider markets and diversified income sources, and this will likely lead to job creation in agricultural and ancillary sectors in the region.

The ADF’s allotment of $99.16 million to develop rice cultivation value chains in West Africa highlights vital strides to elevate the standard of living in the region. While Sierra Leone does not receive immediate funding in this initial round, the indirect benefits from improved regional cooperation, the potential for future investments, and enhanced agricultural practices significantly will boost the country's rice production and economy.

As the project unfolds, the Ministry of Agriculture must stay engaged, ensuring that the country reaps the rewards of regional development initiatives aimed at food sovereignty and economic resilience by 2030.

Although Sierra Leone is not among the primary beneficiaries of this initial funding round, the project holds significant importance for its agricultural landscape by enhanced food security. The overarching aim of the project is to bolster food security throughout West Africa. As part of this regional focus, Sierra Leone stands to benefit indirectly through improved trade dynamics and increased availability of rice, which is a staple food in the country.

The ADF's $99.16 million financial commit, allocated through a combination of grants and concessional loans, is a strategic step towards strengthening the agricultural frameworks of West African nations. Key beneficiaries of the first disbursement include:

By Joshua Mans

15/11/2024 Country

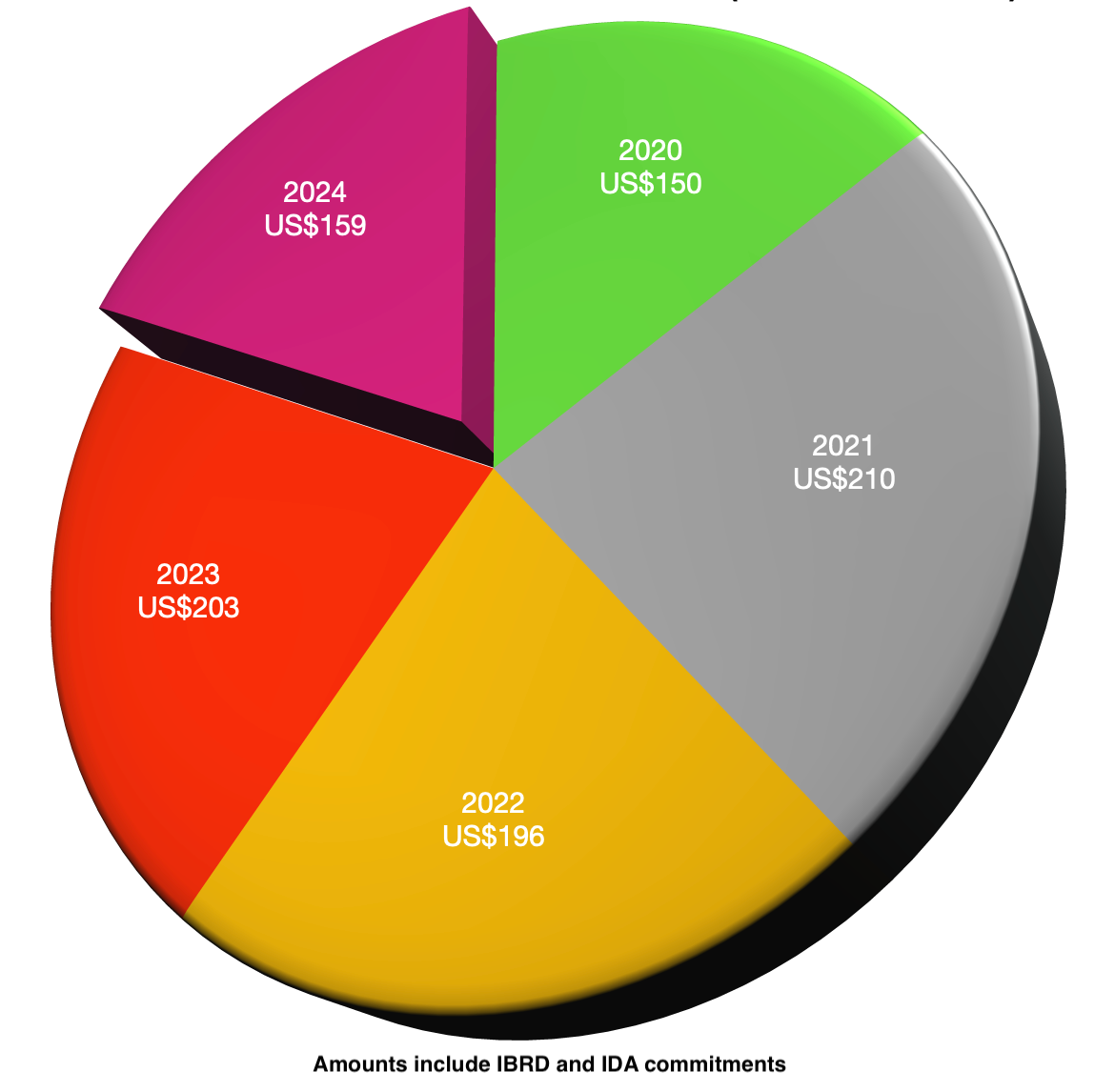

3D Pie Chart of Fiscal Committement

3D Pie Chart of Fiscal Committement

In less than 2 months to 2025, FS here provides a cautious projection into Sierra Leone's partnership with the World Bank viz-a-viz the bank’s commitments to the country in the last 5 years. This projection considers historical trends and current global economic outlooks.

Financial commitments to Sierra Leone declined marginally in the current fiscal year of 2024. At 159 million United States dollar, the account reflects a 21.6 percent drop – about 44 million US dollar - from the 203 million US dollar figure of previous year of 2023.

This commitments are inclusive of the International Bank for Reconstruction and Development (IBRD) and the International Development Association (IDA). Financial commitments to Sierra Leone in 2020 stood at $150 million, a period coincided with the global pandemic, which led to significant economic disruptions worldwide. Despite the adverse conditions, the commitment represented a crucial effort to support the nation’s developmental projects, particularly in healthcare and infrastructure.

As 2024 commitments fell to $159 million, reflecting a sharp decline of approximately 21.6%. This downturn raises concerns about the sustainability of international support amid changing political climates and potential economic stagnation. It indicates a strategic shift in funding priorities by international donors or concerns over ongoing governance issues in Sierra Leone.

The overall trend from 2020 to 2024 reveals a fluctuating but generally supportive environment for Sierra Leone’s development funding.

The commitments surged to $210 million in 2021, reflecting an increase of 40% year-on-year. The sharp increase in 2021 and steady recovery in 2023 demonstrate international cooperation, while the decline in 2024 point to emerging challenges in governance and economic management. This can be attributed to international responses to the pandemic and heightened focus on public health initiatives, as well as infrastructure development. The rise also signifies growing confidence among international donors regarding the government’s ability to utilize these funds effectively.

In 2022, commitments dipped to $196 million, a decrease of approximately 6.7% from the previous year. This decline could be linked to several factors, including fluctuating economic conditions, donor fatigue, and adjustments in funding strategies by international institutions. Nonetheless, the funding remained robust, given the realignment of priorities amid ongoing global challenges.

Fiscal earnestness rebounded in 2023, rising slightly to $203 million. The stable funding environment have been influenced by improved governance measures and strategic alignment between the government’s priorities and donor expectations. Enhanced focus on key sectors like education, health, and economic recovery likely encouraged renewed support from the IBRD and IDA.

Furthermore, the year-on-year commitment figures underscore the importance of maintaining stability and effective governance to attract sustainable international support. Given that these commitments often hinge on the achievements of prior projects (with $74M Sierra Leone Connectivity and Agricultural Market Infrastructure Projects approved on May 29, 2024, to end the year 2029), Sierra Leone must work steadily to enhance its track record in utilizing these funds effectively.

Given the significant decrease in 2024, it would not be unreasonable to forecast a rebound for 2025. Considering an expected stabilization in governance and possible international economic improvements, FS projects approximately $190 million in commitments to Sierra Leone in fiscal 2025. This estimate factors in potential adjustments as donors recalibrate their strategies to tackle recurring challenges faced by the country while aiming for more optimistic, sustained growth. The anticipated ramp-up of existing initiatives and new programs aimed at climate adaptation and economic diversification. Sierra Leone's partnership with the World Bank, through both IBRD and IDA, has been pivotal in attracting funding necessary for developmental projects across the country for growth and stability.

While recent years showcase a commitment to supporting the nation, the fluctuations highlight the need for continued engagement, transparency, and sound governance to ensure ongoing support from global partners. As the country prepares for 2025, focusing on institutional frameworks and strategic alignment with donor should take the centre stage.

By Ibrahim Mansaray

28/10/2024 Finance

Coorperative Bank

Coorperative Bank

A rejuvenated Cooperative Act is in the offing. The revamped Act would see to the re-establishment of the cooperative bank in Sierra Leone. Industry sources told FS that the Act would be reviewed with support from the International Labour Organization (ILO).

The Director of Trade and Professional Head in the Ministry of Trade and Industry, Mr. Emmanuel Conjoh confirmed this in Freetown and disclosed that the Cooperative Act which he said would include new laws and regulations would be in place in the coming year. ” Cooperative Act would be reviewed with support from the International Labor Organization with new laws and regulations. It would be in place next year and the Cooperative Bank that would be reopened also in 2025.” Speaking on the theme ‘One World Through Cooperative Finance’ at the recently held International Credit Union Day celebration in Freetown, Mr. Conjoh gave insight into the Credit Union business in the economy.

The CU, according to him is a serious business that deserve recognition. According to him, CU’s total capital has increased from Le300 million at the beginning to Le20 billion presently and from the numbers of Credit Union I the economy increased from 6 to 26 presently. Mr. Conjoh noted that the country cannot develop if 90% of the businesses are in the informal sector. He disclosed that there are less than three million account holders presently out of a population of 8 million people in the country.

He charged the existing Credit Unions to promote and improve the livelihoods of their members, adding that CUs started in the country in the 1970s, ‘and they had a bank of their own but it later closed down’. Mr. Conjoh appealed to CUs to capture the 300,000 artisanal miners, commercial motorbike ‘okada’ riders, tricycle riders and artisanal fishermen. He also disclosed plans by the Ministry to formalize the informal sector, review the legal and regulatory space noting that CUs can do more and that they have no time to waste revealing that the Ministry would this year establish its own CU, that there are 18,000 civil servants in the country.

Earlier, the Chairman of the National Cooperative Credit Union Association (NaCCUA), Mr. Lamin Kamara revealed that CUs are an economic empowerment, that the day has been celebrated since 1948 to highlight the incredible work they are doing globally, recalled that the celebration this year stated with a three-days Credit Union Supervisory Workshop for CU stakeholders to educate them about the essence and role of the Supervisory Board followed by a symposium.

He also recalled the two Memorandums of Understanding signed between the Bank of Sierra Leone and the Department of Cooperatives on the one hand and the other between the Bank of Sierra Leone and NaCCUA in June this year that has bestowed a lot of confidence in CUs.