Sierra Leone’s Persistent Trade Deficit with Britain

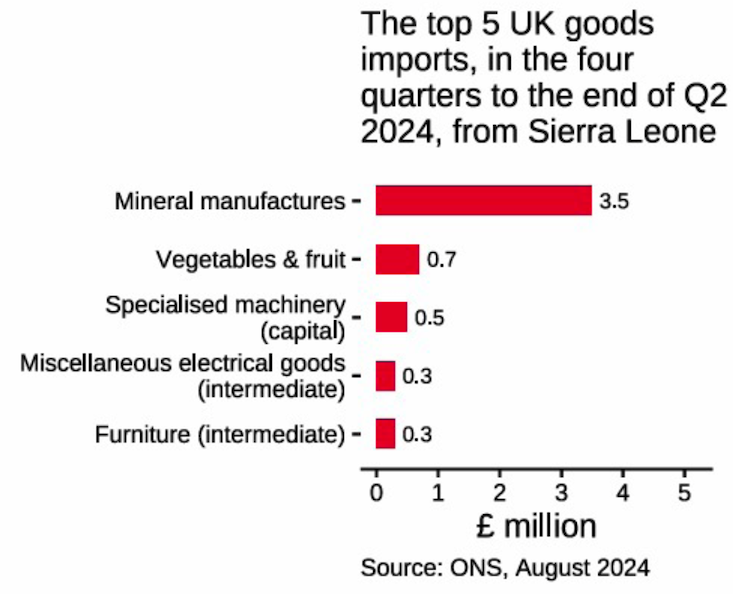

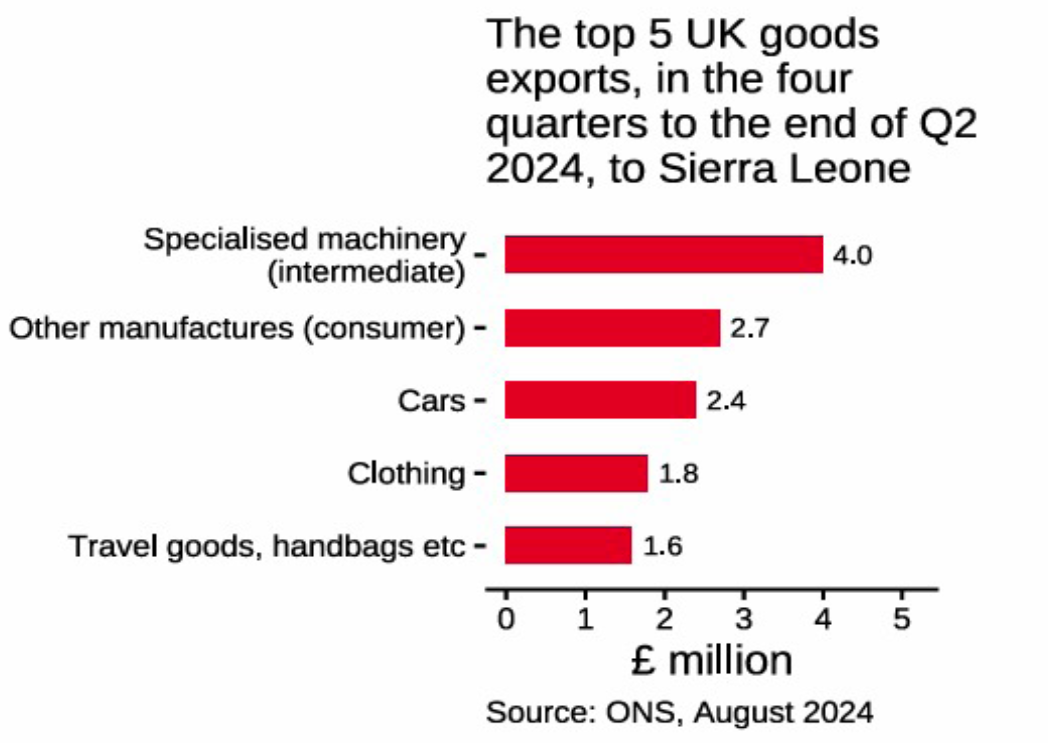

UK Goods Export & Import

UK Goods Export & Import

For the umpteenth time, Sierra Leone has again slipped in its trade relations with the United Kingdom. Reporting total trade in goods and services -exports plus imports – between the UK and Sierra Leone in the four quarter to end June, 2024, the UK Trade Office declared a total of £77 million pounds - a decrease of 2.5 percent or £2 million in current prices from the four quarters to the end of Q2 2023.

Of this £77 million, UK’s total exports to Sierra Leone during the review period amounted to £59 million -an improvement of 3.5 percent translating to a gain of £2 million in current prices. Sierra Leone’s exports (UK imports) during the period amounted to £18 million. A decrease of 18.2 percent or £4 million in current prices, compared to the four quarters to the end of quarter 2 in 2023.

Sierra Leone was the UK’s joint 156th largest trading partner in the four quarters to the end of Quarter 2 2024 – the period under review. It accounted for less than 0.1 percent of total UK trade during this period. In 2022, the inward stock of foreign direct investment (FDI) from the UK in Sierra Leone was £6 million, 100.0% or £3 million higher than in 2021. In 2022, Sierra Leone accounted for less than 0.1% of the total UK inward FDI stock.

The trade imbalance has always left Sierra Leone in deficit as it’s importing far more goods and services than it exports to Britain. It is an imbalance with serious implications for the country's economy with impact on several critical areas. Chief among this is the impact on the country’s foreign exchange reserve. The country requires more foreign currency, particularly the British pounds sterling to pay for its imports. The growing demand for FX automatically exerts pressure on the reserves, leading to a depreciation of the currency. A weaker Leone increases import costs, strains the economy and drives inflation.

To finance the trade imbalance, the government may have to resort to borrowing more from external sources. This could increase the country’s external debt burden. This diversion of funds can adversely affect vital sectors such as healthcare, education, and infrastructure.

Dependence on imports as shown by the trade imbalance would equally harm local employment and hinder local industries. When the market is dominated by imported goods, domestic producers struggle to compete, resulting in decreased local production, job losses, and economic stagnation. This reliance also discourages diversification and innovation within Sierra Leone's economy.

A persistent trade deficit contributes to a negative balance of payments, undermining the country's overall financial stability. This situation may deter foreign investors and obstruct Sierra Leone's ability to secure favorable trade agreements or loans.

The trade imbalance highlights structural issues within Sierra Leone’s economy, such as limited manufacturing capacity and an overreliance on exporting raw materials with low added value. For instance, Sierra Leone's exports to Britain primarily consist of commodities, while imports are predominantly finished goods, thereby perpetuating unequal trade dynamics.

To address the trade deficit, the government should adopt the following strategies to reduce reliance on imports and create jobs. Government to diversify exports and develop non-traditional export sectors, capable of increasing foreign exchange earnings. Also, leveraging partnerships to secure better access for Sierra Leonean goods in British markets can help improve the trade balance. Attracting investment in export-oriented industries can also enhance production and competitiveness. Addressing this imbalance is essential not only for improving trade relations with Britain but also for building a more resilient and self-sufficient Salone economy.

22-11-2024